Jun 07 2024

Unsold housing stocks across seven major cities have risen by 24% since 2019 due to higher supply, but developers are expected to take 31% less time to sell these units because of strong sales momentum, according to a new report.

The report noted that actively selling unsold housing inventory reached about 4,68,000 units by March 2024 — a 24% increase since December 2019 — across seven major cities.

Despite the rise in inventory, there has been a significant reduction in the estimated time needed to sell these properties. This assessment is based on average sales rates recorded over the past eight quarters.

There has been a 31% drop in the time required to clear active unsold stock. In the first quarter of 2024, the liquidation period fell to 22 months, compared to 32 months at the end of 2019, driven mainly by a sharp surge in housing demand.

The regions covered in the analysis include major metropolitan areas and their surrounding suburbs across the seven key cities.

https://www.livehomes.in/news_letter

Jun 06 2024

Luxury real estate demand may see moderation in near future

The luxury real estate segment is likely to plateau in the near-future and affordable housing may take off as the new government takes charge, said Pankaj Kapoor, founder and managing director of real estate research firm Laisas Foras. Niranjan Hiranandani, the managing director and co-founder of Hiranandani Group, said the new government should take steps to ensure affordable housing is possible in cities such as Mumbai. “Today, almost 50 percent of the cost of the house is in government taxes, charges for development, floor space index and goods and services tax. As far as affordable housing is concerned in Mumbai and the suburbs, these taxes need to come down otherwise it is just not possible. Affordable housing doesn’t exist because the government charges are just too high,” Hiranandani told CNBC-TV18. On the real estate outlook of the financial capital of the country, Hiranandani said he is upbeat and believes change in political composition in both Maharashtra and the country, following the outcome of the Lok Sabha elections 2024, will not have any impact. Apart from the state, the Central government also has prioritised infrastructure of Mumbai. He said, “… the central government’s commitment for the city includes bullet train, Delhi-Mumbai industrial corridor… if you look at Mumbai separately, in the next two years 330 km of metro will be coming up, we have a coastal road going to be delivered in the next three months and we have a cross harbour link, which is opening a new scope of development in the city.” The support will be there as far as affordable housing is concerned despite INDIA bloc getting a higher number in the state, he said.Moreover, Hiranandani believes that the new government, which will take charge after the upcoming Maharashtra elections, will prioritise slum redevelopment. With the kind of mandate the Prime Minister Narendra Modi-led government at the Centre received, Kapoor believes affordable segment is likely to get a boost. However, he also noted that investment in infrastructure is unlikely to slowdown despite the less-than-expected mandate for the saffron party.

Jun 05 2024

New Government must bring policy reforms in realty sector NAREDCO

The real estate sector is at a crucial point, with great growth potential but significant challenges. To reach a market size of USD 1 trillion by 2030 and become a net-zero carbon industry by 2047. Tuesday demanded that the new government should bring policy reforms for growth in real estate sector and provide tax incentives to home buyers as well as developers to boost housing demand. The association also sought streamlining of getting approvals to develop projects. Lok Sabha elections 2024, , "The real estate sector is at a crucial point, with great growth potential but significant challenges. To reach a market size of USD 1 trillion by 2030 and become a net-zero carbon industry by 2047, we need government support." This can be achieved by setting the first Rs 20 lakh or Rs 25 lakh of a home loan at a 5 per cent interest rate for the first five years, l (India), the infrastructure sector along with the real estate sector is key for achieving the goal of 'Vikshit Bharat'. We also expect the new government to address some of the challenges faced by these sectors and take the lead in convincing the GST Council

https://www.livehomes.in/news_letter

Jun 04 2024

Home Loan borrowers may have repaid higher amounts

Mortgage disbursals are far exceeding the amount of outstanding home loans indicating faster industry-level growth and a pronounced revival in incomes that has prompted end-users to prepay liabilities or reduce debt through lump-sum part payments ahead of schedule. An analysis of data showed that higher repayments and prepayments optically limit the pace of mortgage expansions. In FY23, for instance, the combined outstanding home loan portfolio of public sector and private banks and housing finance companies, which account for a big majority of the home loan market in the country was, Rs 3.62 lakh crore. But disbursements were much higher - at Rs 8.08 lakh crore. In FY24, State Bank of India, which has 25 percent of market share, said its outstanding portfolio rose 13 percent disbursements rose 17 percent and sanctions rose 21 percent. For Bank of India, the outstanding home loans rose Rs 8,000 crore in FY24, while disbursal rose Rs 23,000 crore. With the revival of the economy and improvement in the income levels, sizable borrowers of home loans are using their surplus funds to repay and prepay their loans so that the interest burden is also less, said a senior analyst with a rating agency. In FY23, for instance, the combined outstanding home loan portfolio of public sector and private banks and housing finance companies, which account for a big majority of the home loan amrket in the country was, Rs 3.62 lakh crore .

May 31 2024

Conveyance deeds for four separate high-value properties, cumulatively worth ?106.4 crore, have been registered individually in a super-luxury residential project in Gurugram.

According to official documents, these large apartments — ranging between 7,361 sq ft and 9,419 sq ft — were originally booked and purchased between 2015 and 2022, but their conveyance deeds were executed only in April 2024. The properties were bought separately by two different buyers.

One buyer purchased a 7,461 sq ft luxury apartment in August 2022, priced at ?27.02 crore, which included four car parking slots. The conveyance deed for this unit was registered on April 29, 2024, with ?1.89 crore paid as stamp duty.

Another family entered into an agreement in June 2019 to purchase a 7,361 sq ft apartment in the same project for ?22.55 crore, with the final payment completed in March 2021. The conveyance deed was executed on April 26, 2024, and ?1.35 crore was paid as stamp duty for the transaction.

https://www.livehomes.in/news_letter

May 28 2024

Leasing by Global Capability Centres in India

Global Capability Centres (GCC) https://www.ey.com/en_in/consulting/global-capability-centers are making huge strides in india with office space leasing by such offshore units of multinational firms increasing by 17 percent year-on-year to 22.5 million square feet in 2023-2024. The growth during April 2023-March 2024 was primarily driven by key sectors such as Engineering and Manufacturing, BFSI (Banking, Financial Services, and Insurance) and Technology sectors https://www.rsm.global/india/service/banking-financial-services-and-insurance-bfsi . In January-March 2024, GCCs had a 29 percent share of the total office space leased in India.

Around 60 percent of the total GCC leasing in January-March 2024 was in Bengaluru followed by Hyderabad (26 percent) and Delhi NCR (9 percent). Mumbai and Pune contributed 4 percent and 1 percent each during the quarter.

GCC sector saw a 30-35 percent share of total office leasing in India in the 2017-2019 period with over 1,250 operational GCCs. Between 2020 and 2022, GCCs accounted for 38–43 percent of the total office space leasing, housing over 1,580 operating GCCs with a talent pool of 1.66 million as of 2022. India is expected to host over 1,900 GCCs by 2025 with a professional talent pool that exceeds 2 million.

The report stated that major global players in sectors like BFSI, technology, and engineering and manufacturing (E&M) are anticipated to grow their GCC presence in India.

https://www.livehomes.in/news_letter

May 27 2024

The Managing Director and Chief Executive Officer of a wealth and alternatives-focused asset firm purchased two sea-view luxury apartments in a super-premium residential tower in Mumbai’s Worli area for a total of ?170 crore. The apartments cover 12,900 sq. ft. of built-up area on the 45th and 46th floors of the tower. The deal was struck at approximately ?1.31 lakh per sq. ft., making it one of the most expensive deals on a per sq. ft. basis in the country.

The apartments were purchased directly from the developer of the project. Both units had been sold by the developer within three years of acquiring them from a joint venture partner. The mixed-use development comprises two towers, one housing a luxury hotel and the other luxury residences.

The apartments bought are part of a larger set of over 60 units previously acquired by the developer from its joint venture partner for a total investment of ?4,000 crore. Another high-profile buyer recently acquired a penthouse of similar size in the same project for ?230.55 crore.

https://www.livehomes.in/news_letter

May 24 2024

A real estate developer reported a net consolidated loss after tax of ?6.71 crore for the quarter ended March 31, 2024, compared with a profit after tax of ?26.75 crore in the corresponding quarter of the previous fiscal, according to a stock exchange filing. The company’s net consolidated total income rose to ?946.84 crore, up 116.97% from ?436.39 crore last year.

For FY24, the company achieved pre-sales of ?5,914 crore, up 90% year-on-year, and launched 12 projects with a saleable area of 9.47 million sq. ft. Investments worth ?410 crore from external investors were successfully returned. The company deployed ?300 crore of land advances using internal accruals and debt.

The board of directors reappointed a non-executive independent director for a second five-year term and declared an interim dividend of ?6.30 per equity share, paid during the quarter.

Sales soared to ?1,947 crore in Q4 FY24, marking a 93% year-on-year growth, with sales volume for the quarter standing at 2.35 million sq. ft. and collections of ?1,094 crore. The company’s net debt stood at ?2,151 crore, with a net debt-to-equity ratio of 1.14, and the weighted average cost of debt was 11.59% as of March 31, 2024.

https://www.livehomes.in/news_letter

Live Services

Live Services

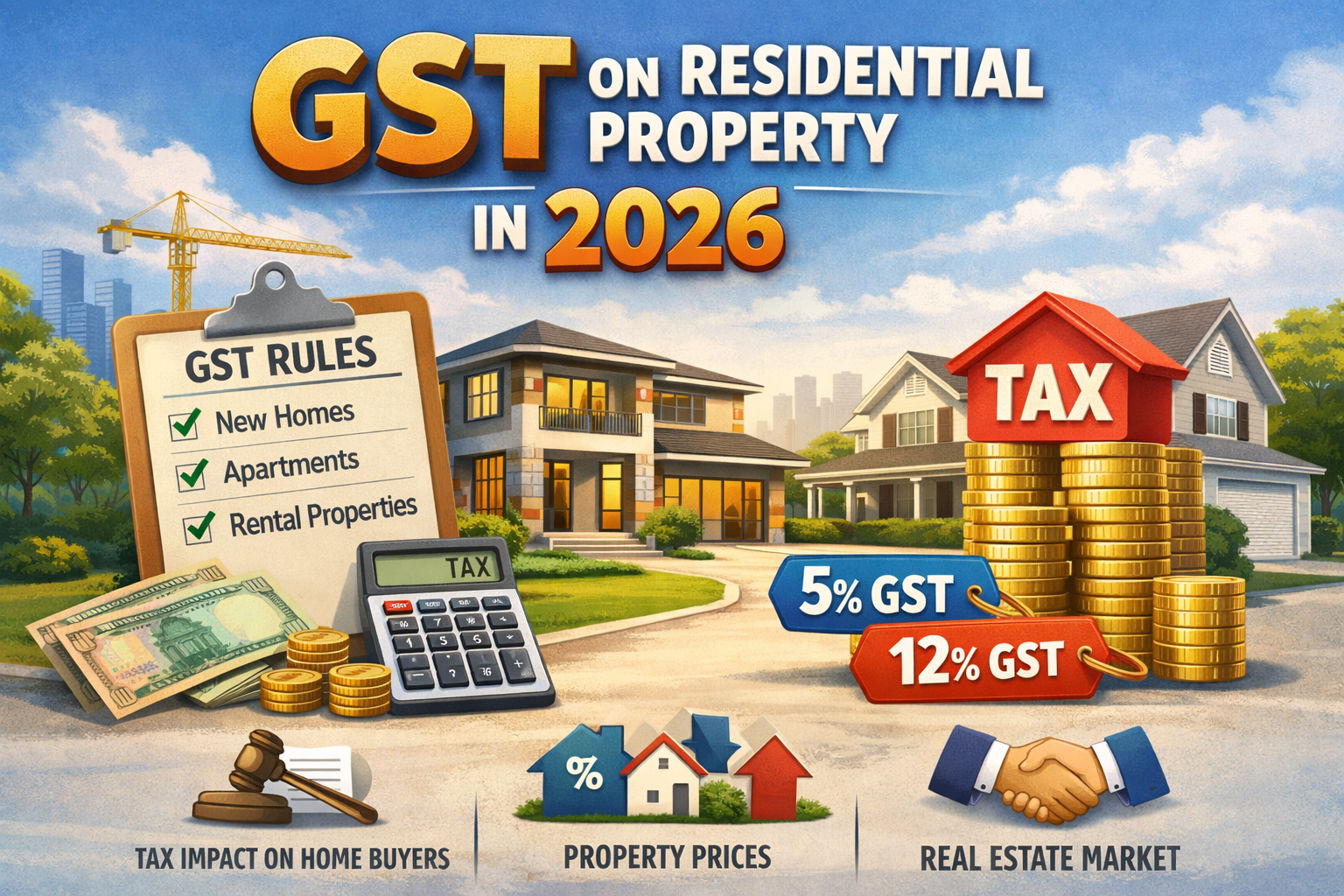

21, Jan 2026

GST on Residential Property in India 2026

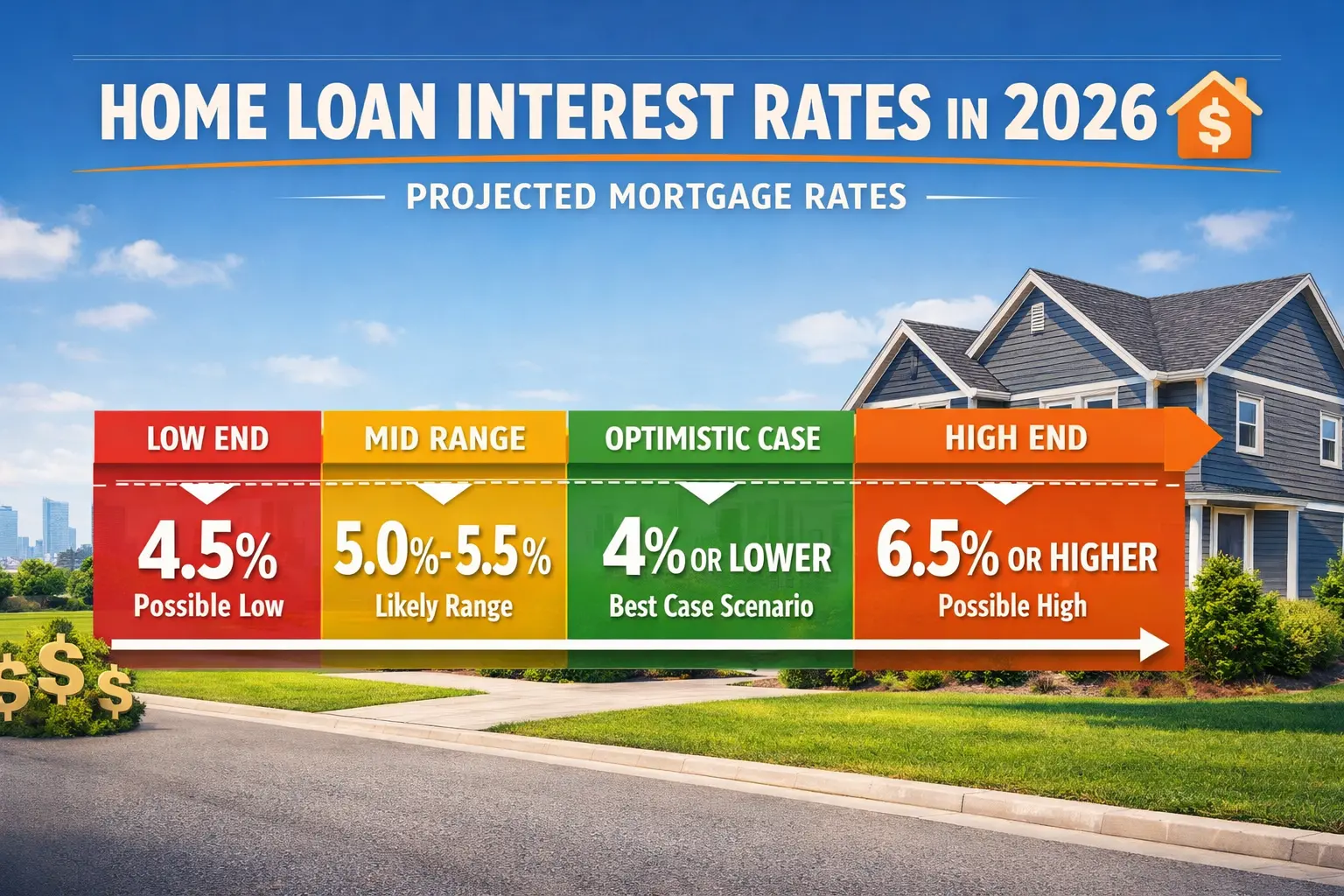

19, Jan 2026

Home Loan Interest Rates in 2026

14, Jan 2026

Which Investment is 100 percentage Safe in IndiaReal Estate Expectations and Policy Wishlist for the 2026 Budget,...

Three Bank Account System for Real Estate Projects to Take...

Centre Launches Rs 2 Billion Project in Chennai, Best Builder...

Warehousing Policy Revealed to Boost Delta Districts and Tier-2 Cit,...

Parandur Airport Resettlement Plan: Model Houses Set Up for Displaced...

Affordable housing boost: CMDA to open 776 homes in North...

Yes, we offer property management services for landlords who require assistance with managing their rental properties. Our services include finding tenants, collecting rent, handling maintenance issues, and ensuring compliance with legal requirements.

Construction is the process of building, assembling, or erecting structures, infrastructure, or facilities.

Look for designers with experience in projects similar to yours, check their portfolio, and ensure they understand your vision and budget.

Trends vary, but some popular ones include sustainable design, biophilic design (connecting with nature), and minimalist aesthetics.

The borrower receives a lump sum of money from the lender, which is then repaid over time with interest, typically through monthly payments.