Feb 17 2026

To ease traffic congestion and curb illegal roadside parking, the civic body has announced plans to construct two multi-level car parking (MLCP) facilities along a major arterial road and in the eastern part of the city. The projects have been allocated a budget of ?25 crore, and tenders are expected to be floated soon. The authorities aim to make the facilities operational by the end of the year. One of the proposed locations is a key arterial stretch that witnesses heavy traffic, with an estimated 10,000 vehicles passing through every hour. Due to inadequate designated parking spaces, many motorists park along the main road while visiting eateries and shopping complexes, often resulting in traffic congestion. The proposed MLCPs will be three-storey buildings with two basement levels. Each facility will accommodate around 40 cars across the two basement floors, with 20 slots on each level. The ground floor will have space for 57 two-wheelers, while the first and second floors will each accommodate 78 bikes. The third floor will provide parking for 103 two-wheelers. Parking charges will be determined after the tender process and land-related formalities are completed. Addressing concerns that spending large sums on such systems could become wasteful expenditure, a senior official stated that illegal parking had increased significantly in market areas and along a key connecting road. The issue was monitored through the Integrated Command and Control Centre (ICCC), and several complaints were received from the public, prompting the decision to proceed with the project. Proper maintenance, the official assured, will be ensured.

https://www.livehomes.in/news_letter

Live Services

Live Services

03, Mar 2026

Why Patta Matters When Buying a Flat in Chennai

02, Mar 2026

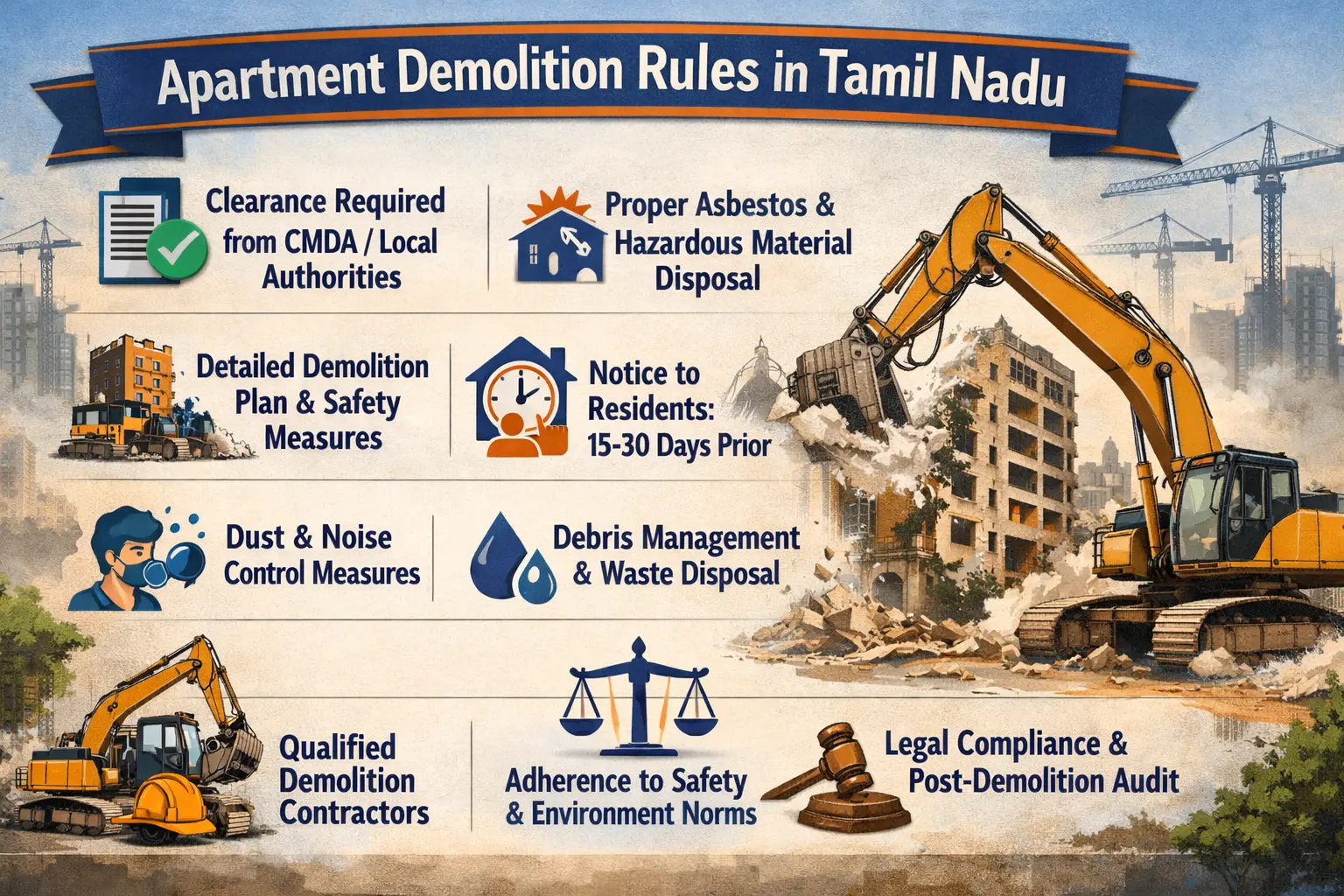

Apartment Demolition Rules in Tamil Nadu

28, Feb 2026

2 & 3BHK Builder Floor Apartment for sale in PorurChennai Metro to develop 73 lakh sq ft at 37...

Residents Secure Four-Lane Bridge Over Cooum River in Chennai, Best...

Encroachment removal intensifies 3,214 structures cleared on key city corridor,...

Tamil Nadu Takes Lead on Rs 1,971 Cr Energy Department...

Property Tax Name Transfer Fixed Fees in Tambaram, Best Builder...

Chennai Residential Market Sees Rise in Women Homebuyers

Yes, we offer property management services for landlords who require assistance with managing their rental properties. Our services include finding tenants, collecting rent, handling maintenance issues, and ensuring compliance with legal requirements.

Construction is the process of building, assembling, or erecting structures, infrastructure, or facilities.

Look for designers with experience in projects similar to yours, check their portfolio, and ensure they understand your vision and budget.

Trends vary, but some popular ones include sustainable design, biophilic design (connecting with nature), and minimalist aesthetics.

The borrower receives a lump sum of money from the lender, which is then repaid over time with interest, typically through monthly payments.