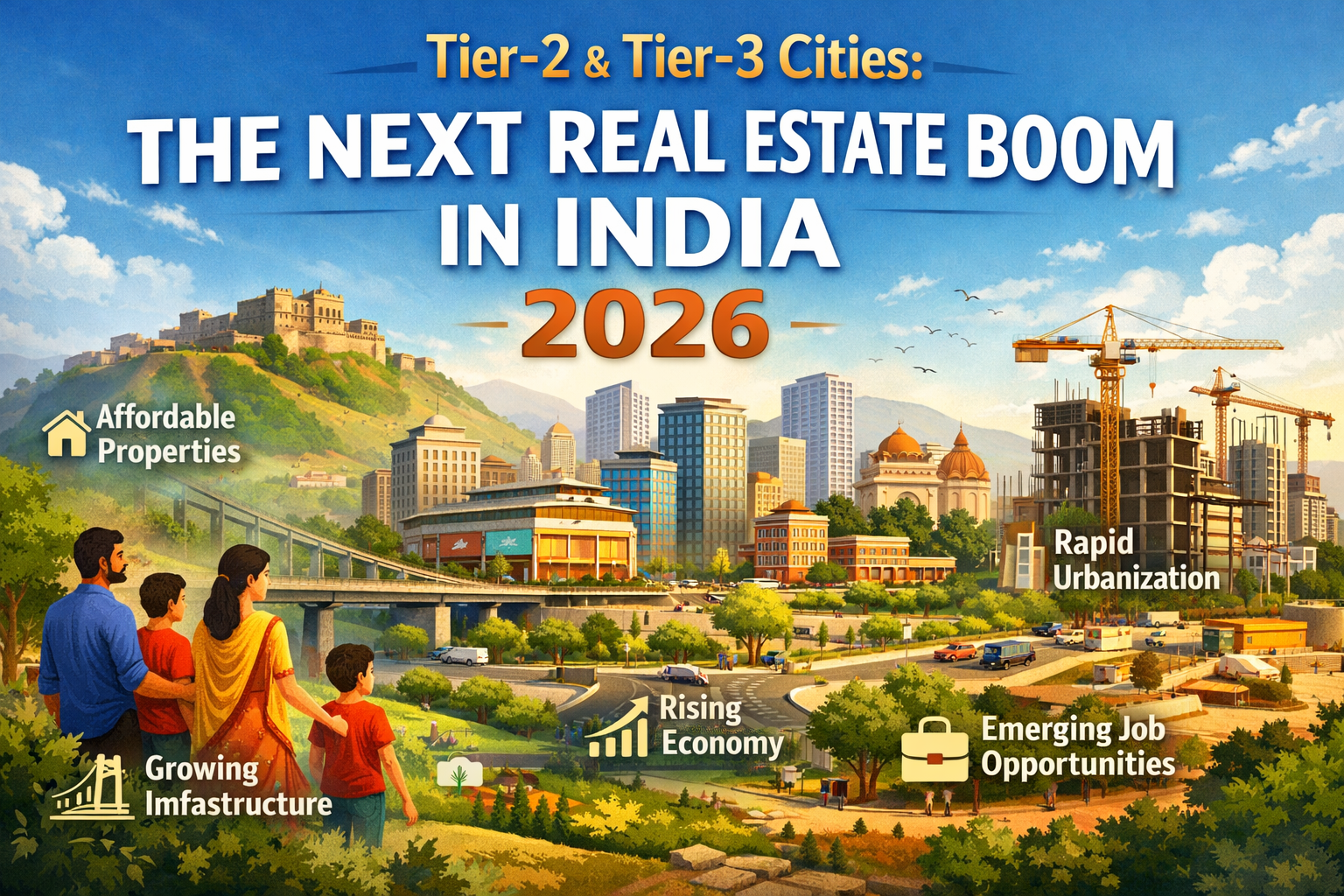

By 2026, India’s real estate growth is expected to be increasingly driven by Tier-2 and Tier-3 cities, marking a major shift away from the long-standing dominance of Tier-1 metropolitan markets. This transformation is not temporary or speculative; it is rooted in deep economic, demographic, and infrastructure changes across the country.

1. Understanding Tier-2 and Tier-3 Cities

- Tier-2 cities are medium-sized urban centers with growing economies, improving infrastructure, and rising populations.

Examples: Jaipur, Indore, Kochi, Coimbatore, Surat, Nagpur, Lucknow.

- Tier-3 cities are smaller urban areas and district headquarters with emerging development potential.

Examples: Udaipur, Guntur, Hubballi, Tiruppur, Siliguri, Alwar.

These cities are transitioning from traditional local economies to modern, diversified urban ecosystems.

2. Key Reasons Behind the Real Estate Boom

a) Infrastructure Expansion

Large-scale public investment is reshaping smaller cities:

- New highways, expressways, bypass roads, and ring roads

- Expansion of rail networks and regional airports

- Smart City projects improving water supply, waste management, roads, and digital infrastructure

Better connectivity directly increases land value, housing demand, and commercial viability.

b) Housing Affordability Advantage

Compared to Tier-1 cities, property prices in Tier-2 and Tier-3 cities are significantly lower:

- Larger homes at lower costs

- Lower land acquisition and construction expenses

- Reduced overall cost of living

This affordability supports strong demand from first-time homebuyers, salaried professionals, and middle-income households.

c) Employment Generation Outside Metros

Economic decentralization is a major driver:

- IT services, BPOs, startups, and manufacturing units are moving to smaller cities

- Industrial corridors, logistics parks, and warehousing hubs are expanding

- Growth of education, healthcare, retail, and service sectors

Job creation leads to sustained demand for residential housing, rental units, and commercial spaces.

d) Demographic and Lifestyle Shifts

Population dynamics strongly favor smaller cities:

- Younger population seeking affordable urban living

- Families preferring less congestion and better work-life balance

- Increased acceptance of remote and hybrid work models

Quality of life factors such as cleaner environments, shorter commute times, and community living play a crucial role.

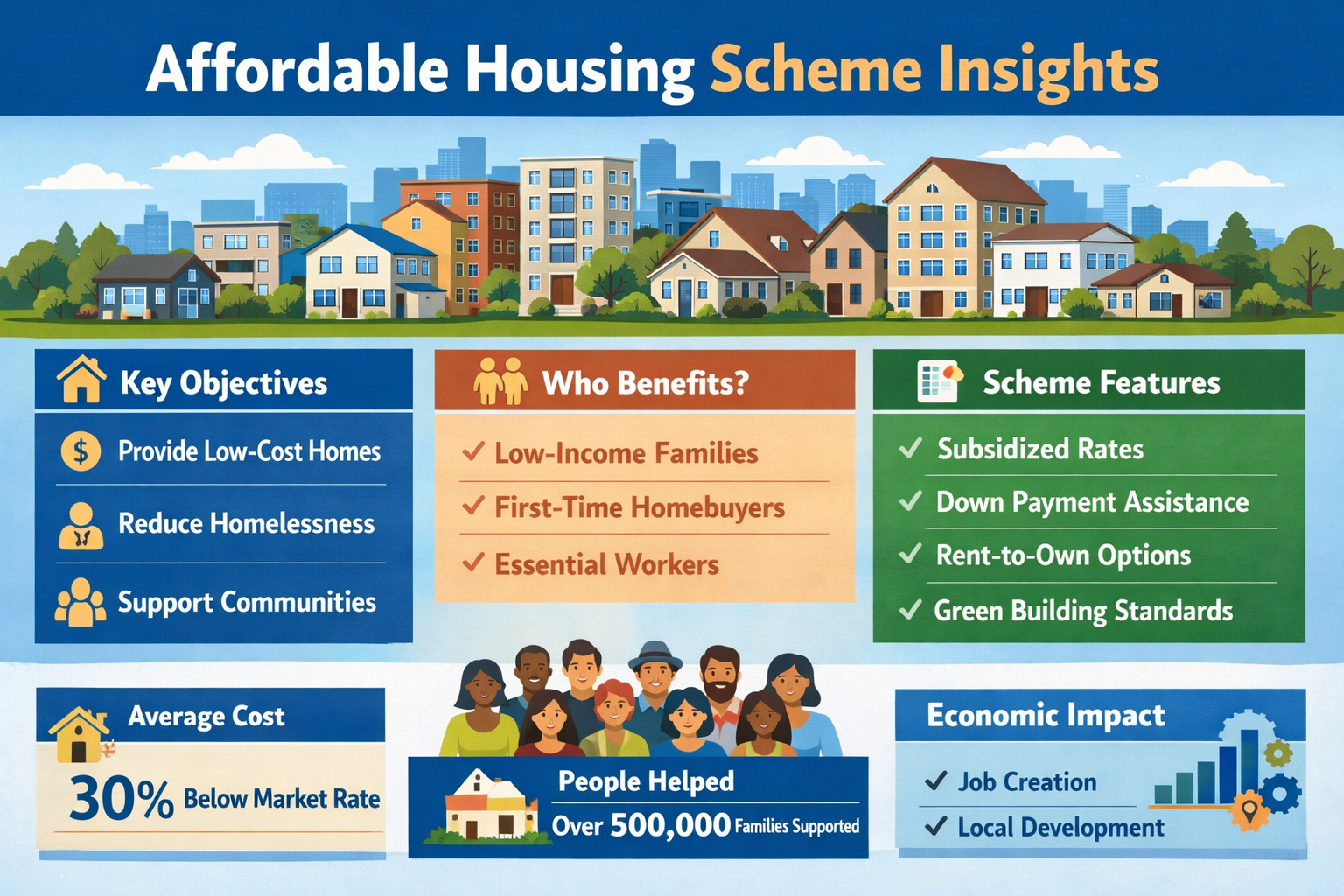

e) Government Housing and Urban Policies

Policy support is strengthening demand and supply:

- Affordable housing schemes encouraging home ownership

- Urban renewal and town planning initiatives

- Incentives for real estate development and formalization

These policies reduce risks and improve transparency in smaller markets.

Also Read: Why Infrastructure Investment Predicts Real Estate Growth

3. Residential Real Estate Trends

Residential real estate forms the backbone of the boom:

- Strong demand for affordable and mid-income housing

- Growth of plotted developments and gated communities

- Increasing preference for ready-to-move properties

- Rising rental demand from students, professionals, and migrants

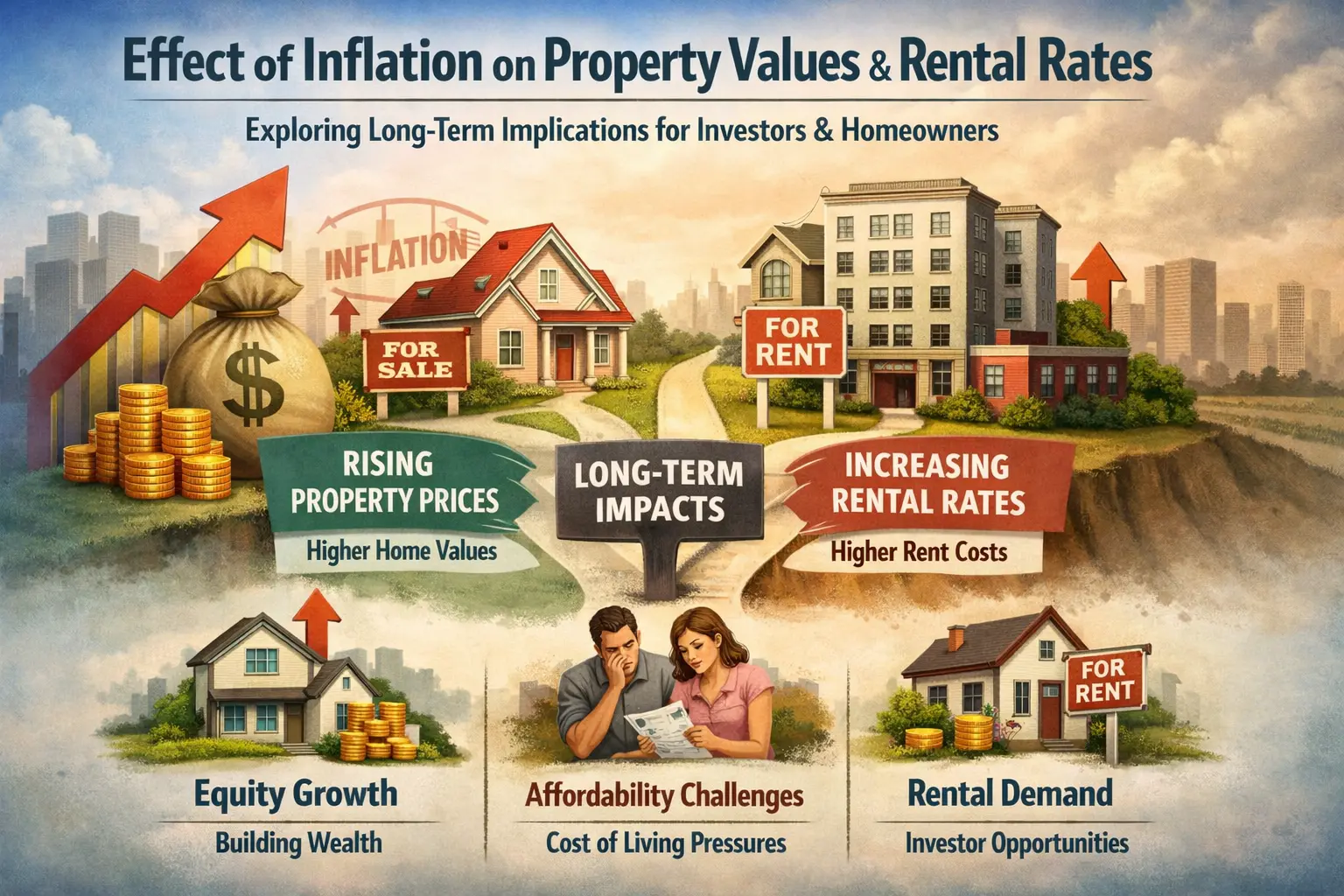

Price appreciation is gradual but steady, supported by real end-user demand rather than speculation.

4. Commercial and Industrial Real Estate Growth

Commercial Real Estate

- Expansion of office spaces and co-working hubs

- Growth of retail centers, malls, and mixed-use developments

- Rising demand for service-oriented commercial properties

Industrial and Logistics Real Estate

- Warehousing demand driven by e-commerce and supply chains

- Manufacturing clusters near highways and ports

- Industrial parks supporting MSMEs and export units

This diversification strengthens the overall real estate ecosystem.

5. Developer and Capital Movement

Real estate developers are increasingly focused on Tier-2 and Tier-3 cities because:

- Lower land costs improve project feasibility

- Faster approvals in some regions

- Strong local demand with lower inventory risk

Both regional and national developers are expanding their presence, increasing project quality and market confidence.

6. Financial Indicators Supporting the Boom

- Rapid growth in home loan disbursements

- Rising registration volumes and transaction values

- Improved access to housing finance in smaller cities

These indicators reflect genuine, broad-based demand, not short-term market hype.

7. Challenges and Limitations

Despite strong momentum, certain challenges remain:

- Uneven infrastructure quality across cities

- Slower absorption in some locations

- Variations in regulatory efficiency and urban planning

- Limited high-end social infrastructure in early-stage cities

However, these challenges are structural and gradually improving with time and investment.

Also Read: Real estate market cycles understanding boom and bust cycles in residential and commercial markets

8. Outlook for 2026

By 2026, Tier-2 and Tier-3 cities are expected to:

- Contribute a larger share of India’s real estate growth

- See sustained residential and rental demand

- Emerge as stable, long-term urban centers

- Reduce over-dependence on Tier-1 cities

The shift represents a rebalancing of India’s urban and real estate growth, aligned with economic decentralization and inclusive development.

Conclusion

The rise of Tier-2 and Tier-3 cities as real estate growth engines is driven by infrastructure, affordability, employment expansion, demographic change, and policy support. This transformation is structural, long-term, and integral to India’s urban future. By 2026, these cities are positioned not as alternatives to metros, but as essential pillars of India’s real estate and economic growth.

https://www.livehomes.in/live_insights