1. Introduction

Village Panchayats are the lowest tier of rural local self-government in Tamil Nadu. They function under the Tamil Nadu Panchayats Act, 1994 and are responsible for providing basic civic amenities in villages. To perform these duties, Village Panchayats are authorized to levy and collect taxes, fees, and charges from residents and establishments within their jurisdiction.

2. Legal Framework

Village Panchayat taxation is governed by:

- Tamil Nadu Panchayats Act, 1994

- Tamil Nadu Panchayats (Assessment and Collection of Taxes) Rules

- Government Orders issued by the Rural Development & Panchayat Raj Department

These laws define:

- Types of taxes

- Maximum and minimum rates

- Assessment procedure

- Collection and recovery methods

- Exemptions and penalties

3. Types of Taxes Levied by Village Panchayats

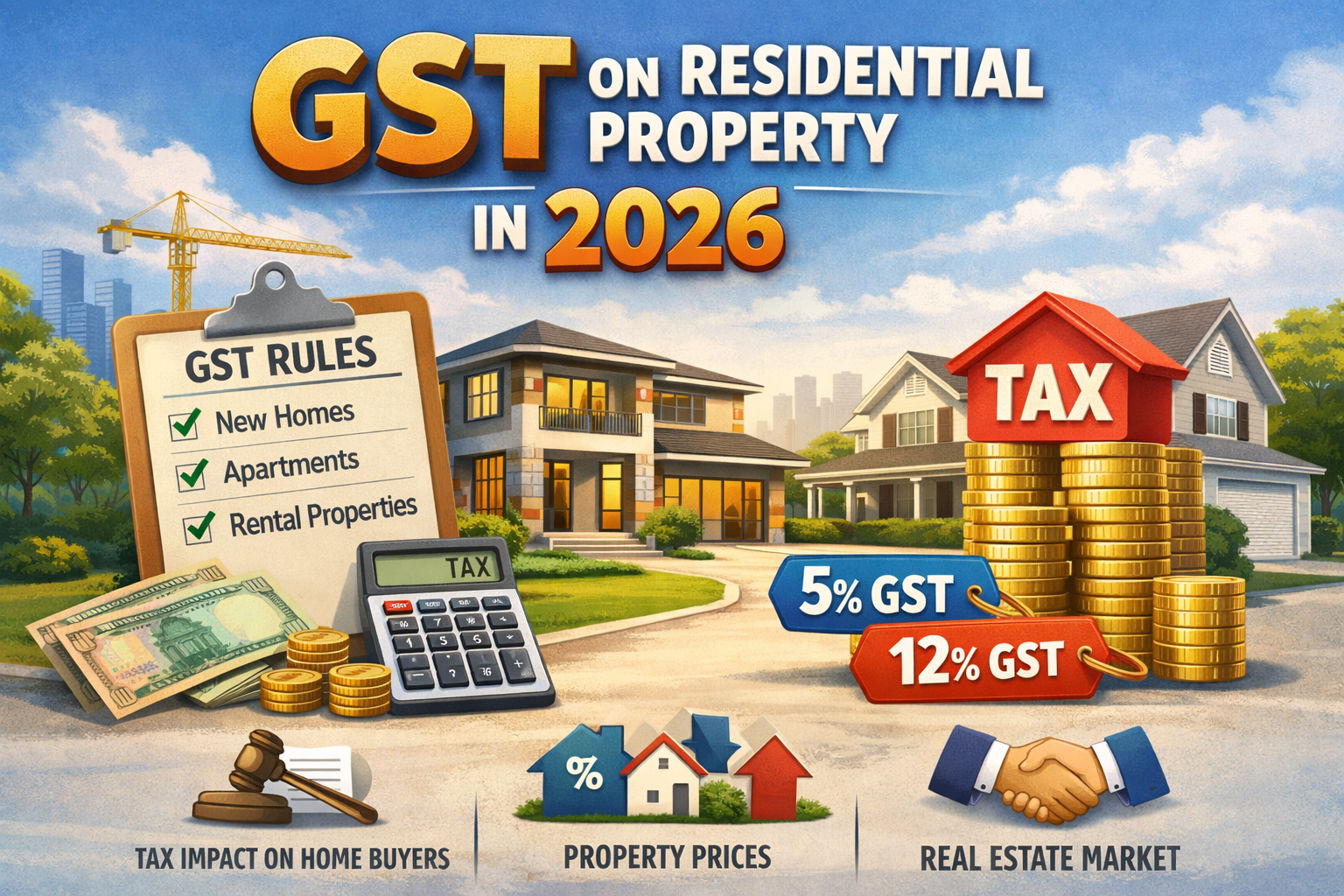

3.1 House Tax / Property Tax

House tax is the primary and compulsory tax levied by Village Panchayats.

Applicability

- Levied on all buildings situated within Village Panchayat limits

- Includes:

- Residential houses

- Commercial buildings

- Industrial buildings

- Shops, godowns, offices

Basis of Assessment

- House tax is assessed based on:

- Nature of use (residential / non-residential)

- Type of construction (thatched, tiled, RCC, etc.)

- Location of the building

- Plinth area

- Annual rental value or capital value (as prescribed)

Collection Period

- Usually collected half-yearly

- Some Panchayats allow annual payment

Purpose

Revenue from house tax is used for:

- Road maintenance

- Street lighting

- Drainage and sanitation

- Drinking water supply

- Public health services

3.2 Professional Tax

Professional tax is levied on persons engaged in professions, trades, callings, or employment.

Applicable To

- Salaried employees

- Traders

- Shop owners

- Small business operators

- Self-employed professionals

Collection

- Generally collected through employers or directly from individuals

- Rates are fixed within limits prescribed by the State Government

Exemptions

- Agricultural income earners

- Certain categories specified by government orders

3.3 Advertisement Tax

Advertisement tax is levied on display of advertisements within Village Panchayat limits.

Covers

- Hoardings

- Banners

- Signboards

- Wall paintings

- Temporary and permanent advertisement structures

Exemptions

- Government advertisements

- Election-related notices

- Public awareness messages

Also Read: A Detailed Overview of Property Tax and Maintenance Charges in Apartments

4. Non-Tax Revenue Sources

Apart from taxes, Village Panchayats collect income through fees and charges, such as:

- Drinking water charges

- Trade license fees

- Market fees

- Cart stand fees

- Fishery lease rent

- Fair and festival fees

- Building plan approval fees

5. Assessment Procedure

- Panchayat officials conduct a survey of buildings and establishments

- Property details are recorded in Panchayat registers

- Tax demand is calculated based on prescribed rules

- Demand notice is issued to the taxpayer

- Objections, if any, may be submitted for review

6. Collection of Taxes

Modes of Collection

- Cash payment at Village Panchayat Office

- POS machines at Panchayat offices

- Online payment through State portal

Online System

Tamil Nadu has introduced a Village Panchayat Tax Management System to improve transparency and efficiency.

7. Penalty and Recovery

- Late payment attracts penalty or interest

- Continued default may lead to:

- Attachment of property

- Disconnection of water supply

- Legal recovery proceedings

8. Exemptions

Certain properties may be exempted, including:

- Government buildings

- Educational institutions (as notified)

- Places of worship (subject to conditions)

- Buildings used for public charitable purposes

9. Utilization of Panchayat Tax Revenue

Collected revenue is used exclusively for:

- Village infrastructure development

- Public health and sanitation

- Drinking water schemes

- Maintenance of public assets

- Welfare programs at village level

10. Official Websites

- Village Panchayat Tax Portal:

- Rural Development & Panchayat Raj Department, Tamil Nadu:

Frequently Asked Questions (FAQs)

Q1. Is Village Panchayat tax mandatory?

Yes. Taxes levied by Village Panchayats are compulsory under law.

Q2. Who fixes Village Panchayat tax rates?

Village Panchayats fix tax rates within limits prescribed by the Tamil Nadu Government.

Q3. Can house tax be revised?

Yes. House tax can be revised periodically based on government guidelines.

Q4. How can I check my house tax details?

House tax details can be checked through the Village Panchayat office or the official online portal.

Q5. Is online payment safe and valid?

Yes. Online payments through the official portal are government-authorized and receipts are legally valid.

Q6. What if my property details are wrong?

You can submit a correction request to the Village Panchayat for reassessment.

Q7. Are vacant houses taxable?

Yes. Vacant buildings within Panchayat limits are also liable for house tax.

Q8. Is professional tax applicable to farmers?

Agricultural income is generally exempt, but non-agricultural commercial activities may attract tax.

Q9. Can Panchayat seize property for non-payment?

Yes. Persistent default may lead to recovery proceedings as per law.

Q10. Why should Village Panchayat tax be paid?

To ensure proper maintenance of village infrastructure and delivery of essential civic services.

https://www.livehomes.in/blogs