Home loan interest rates in 2026 are expected to reflect a period of economic normalization and stability after several years of inflation control, interest rate hikes, and global uncertainty. While exact figures differ by country and lender, the overall trend points toward moderate and balanced interest rates.

1. Understanding Home Loan Interest Rates

A home loan interest rate is the cost you pay to a bank or financial institution for borrowing money to buy, build, or renovate a house. It is expressed as a percentage of the loan amount and is charged annually.

Interest rates determine:

- Your monthly EMI

- Total interest paid over the loan tenure

- Long-term affordability of owning a home

Even a small change in interest rate can result in large differences in total repayment, especially for long-term loans (20–30 years).

2. Economic Conditions Affecting 2026 Rates

A. Inflation Control

Inflation was high in the early 2020s, forcing central banks to increase interest rates aggressively. By 2026:

- Inflation is expected to be closer to target levels

- Cost pressures are likely to stabilize

- Central banks may maintain or slightly reduce benchmark rates

Lower inflation usually supports lower home loan interest rates.

B. Central Bank Monetary Policy

Central banks influence lending rates by adjusting policy rates:

- Repo rate

- Federal funds rate

- Base or benchmark lending rate

In 2026, central banks are expected to:

- Avoid sharp rate hikes

- Focus on economic stability

- Support housing and long-term investments

This results in stable or mildly declining mortgage rates.

C. Economic Growth & Employment

- Stable job markets increase borrowing confidence

- Controlled growth reduces the need for aggressive rate increases

Healthy economic growth supports balanced interest rates, neither too high nor too low.

3. Expected Home Loan Interest Rate Range in 2026

Projected Interest Rate Scenarios

Best-Case Scenario

- Around 4.0% or lower

- Conditions:

- Low inflation

- Strong economic stability

- High competition among banks

Most Likely Scenario

- 5.0% to 5.5%

- Conditions:

- Controlled inflation

- Stable central bank policy

- Normal housing demand

High-End Scenario

- 6.5% or higher

- Conditions:

- Inflation resurgence

- Global economic shocks

- Tight monetary policy

Most borrowers in 2026 are expected to fall into the mid-range category.

4. Fixed vs Floating Home Loan Rates in 2026

Fixed Interest Rate Home Loans

- Interest rate remains constant for a specific period or entire tenure

- EMIs remain unchanged

Advantages

- Predictable monthly payments

- Protection from future rate increases

- Ideal for risk-averse borrowers

Disadvantages

- Slightly higher starting rate

- Limited benefit if rates fall

Floating (Variable) Interest Rate Home Loans

- Interest rate changes based on market conditions

- EMIs may increase or decrease

Advantages

- Lower initial rate

- Benefit from future rate cuts

Disadvantages

- EMI uncertainty

- Risk if rates increase unexpectedly

In 2026, floating rates may be preferred if rate cuts are expected gradually.

Also Read: Different Types of Home Loan

5. Factors That Decide Your Actual Interest Rate

Even in the same year, borrowers may get different rates due to personal and financial factors:

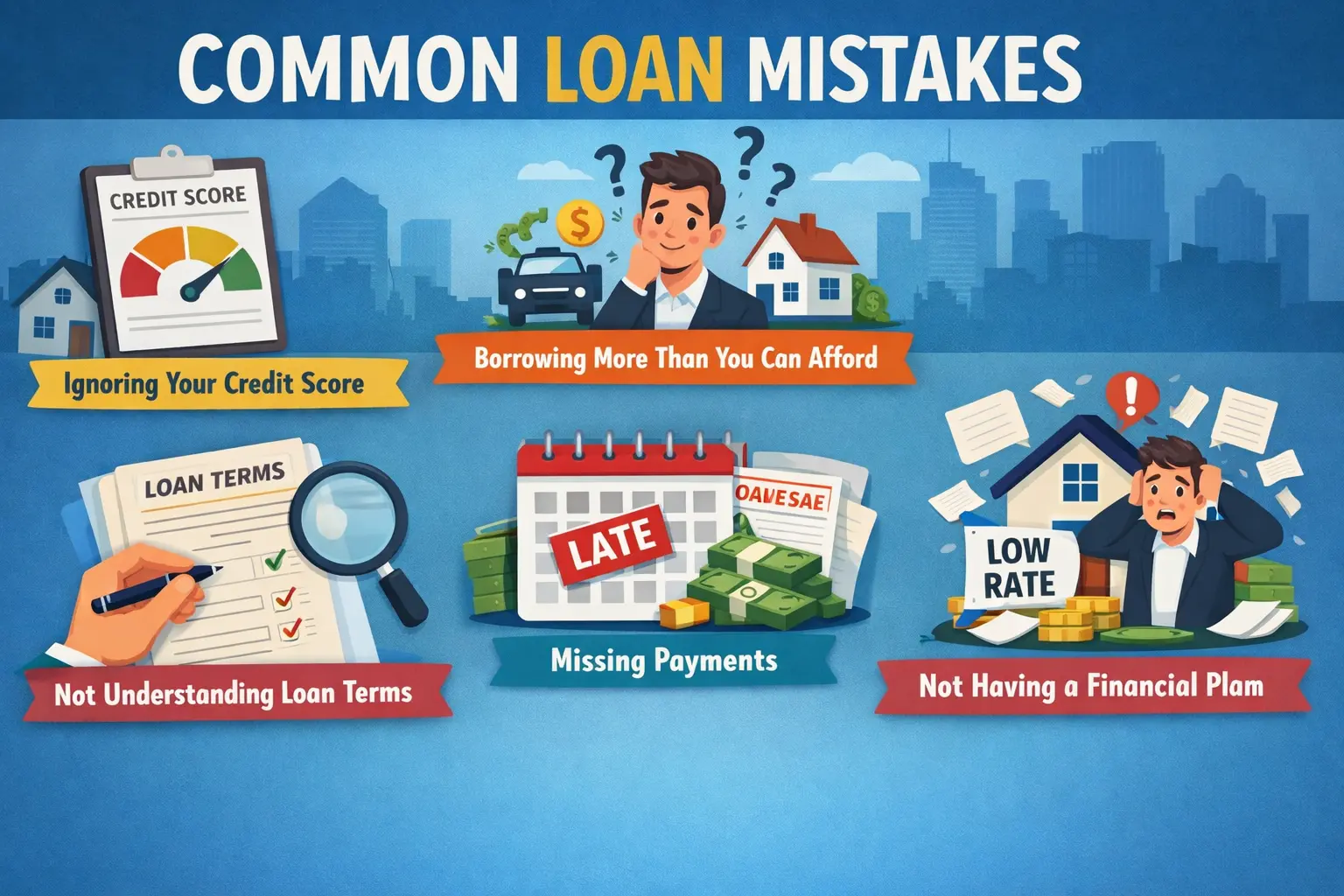

A. Credit Score

- High credit score (750+) → Lower interest rate

- Low credit score → Higher interest rate

B. Income & Employment Stability

- Salaried professionals with stable income get better rates

- Self-employed borrowers may pay slightly more

C. Loan Amount & Tenure

- Shorter tenure → Lower total interest

- Longer tenure → Higher total interest paid

D. Loan-to-Value Ratio (LTV)

- Lower loan amount compared to property value → Better rates

6. Impact of Interest Rates on EMIs (Illustrative)

For a long-term loan:

- A 0.5% reduction can save a large amount over 20–25 years

- Lower rates reduce EMI burden and total interest paid

This makes timing and negotiation extremely important.

7. Housing Market Outlook in 2026

- Property prices expected to rise moderately

- Demand driven by urbanization and population growth

- Affordable housing initiatives may continue

Stable interest rates in 2026 can:

- Encourage first-time buyers

- Improve housing affordability

- Support long-term real estate investments

8. Smart Borrowing Strategies in 2026

- Maintain a strong credit score

- Compare offers from multiple lenders

- Choose floating rate if rates are expected to decline

- Make partial prepayments when possible

- Refinance if rates drop significantly later

Frequently Asked Questions (FAQs)

Q1. Will home loan interest rates decrease in 2026?

Rates are expected to be stable or slightly lower, depending on inflation and central bank decisions.

Q2. What is the expected average home loan interest rate in 2026?

For most borrowers, it is expected to be around 5.0% to 5.5%.

Q3. Is 2026 a good year to buy a house?

Yes, if:

- Your income is stable

- Interest rates are steady

- You plan long-term ownership

Q4. Which is better in 2026 – fixed or floating interest rate?

- Floating is better if rates are expected to fall

- Fixed is better if you want EMI stability

Q5. How can I get the lowest home loan interest rate?

- Improve credit score

- Reduce existing debts

- Opt for shorter tenure

- Negotiate with lenders

Q6. Will inflation affect home loan rates in 2026?

Yes. Inflation is the main factor influencing interest rates.

Q7. Do government policies affect home loan rates?

Yes. Subsidies, housing schemes, and monetary policies can reduce borrowing costs.

Q8. Can I refinance my home loan in 2026?

Yes. If interest rates drop, refinancing can significantly reduce EMI and total interest.

Q9. Are home loan rates same for everyone?

No. Rates depend on:

- Credit score

- Income

- Loan amount

- Lender policies

Q10. Should I wait or buy a house in 2026?

If rates are stable and your finances are strong, waiting may not give major benefits. Long-term planning matters more than short-term rate changes.

Conclusion

Home loan interest rates in 2026 are expected to be balanced, borrower-friendly, and stable. While they may not be as low as historical lows, they are unlikely to rise sharply. With proper planning, comparison, and financial discipline, 2026 can be an excellent year for home ownership.

https://www.livehomes.in/blogs