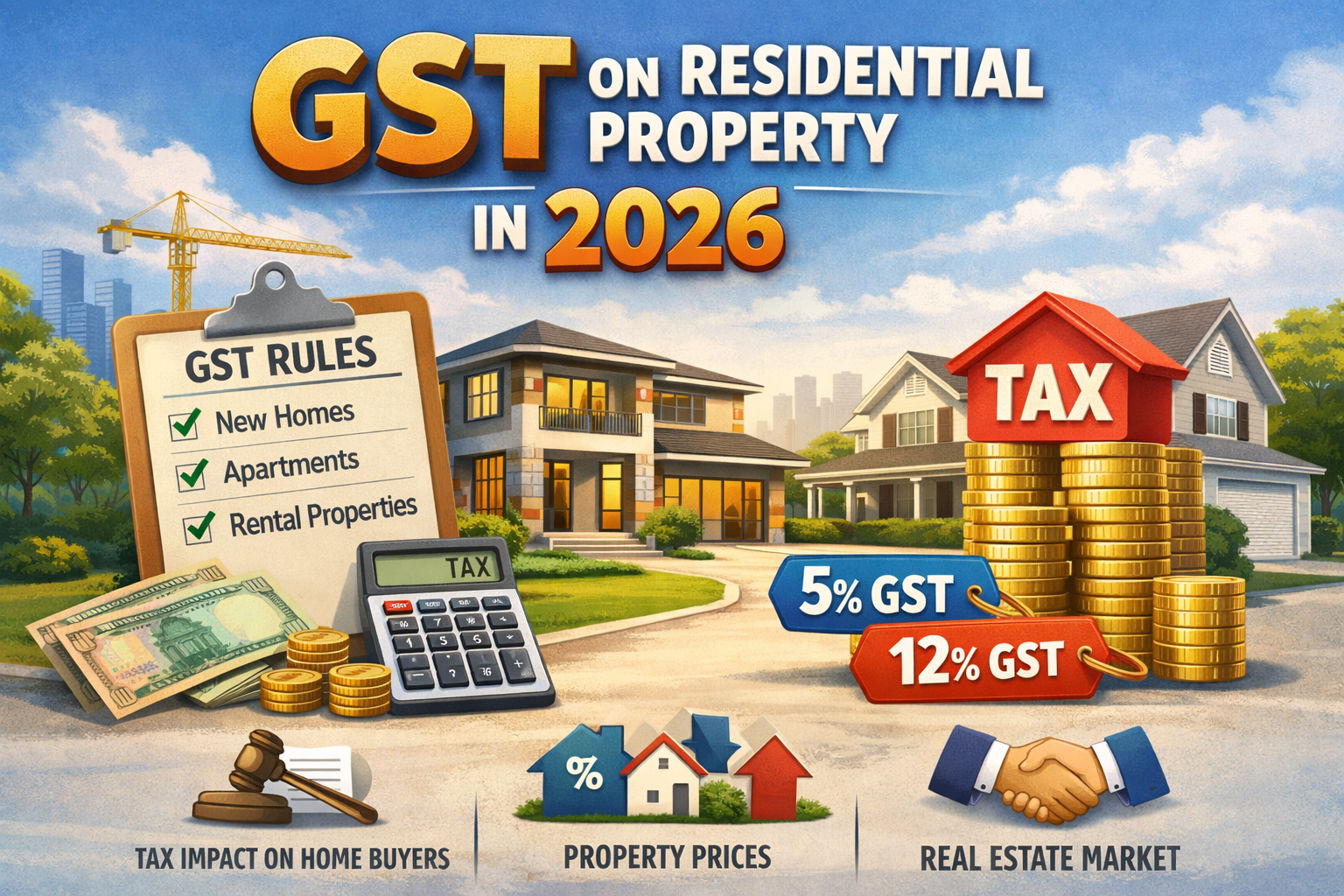

1. Overview of GST and Real Estate

Goods and Services Tax (GST) applies to construction-related services, not to the sale of immovable property itself. Therefore, GST on residential property depends on whether construction service is involved at the time of sale.

Key principle:

- GST applies only when a property is sold before completion.

2. When is GST Applicable on Residential Property?

| Situation | GST Applicable |

| Under Construction property | Yes |

| Ready to move property | No |

| Property with Completion Certificate | No |

| Resale Property | No |

| Purchase of land / plot | No |

3. GST on Purchase of Residential Property

A. Under-Construction Residential Property

GST is applicable when:

- Construction is ongoing

- Completion Certificate (CC) or Occupancy Certificate (OC) has not been issued

GST Rates (2026)

| Property Category | GST Rate | ITC |

| Affordable Housing | 1% | Not Available |

| Non Affordable Housing | 1 % | Not Available |

These rates apply without Input Tax Credit (ITC).

B. Affordable Housing – Definition

A house is classified as affordable housing if both conditions are met:

| Criteria | Metro Cities | Non Metro Cities |

| Carpet Area | < 60 sq m. | <90 sq m |

| Property Value | < Rs 45L | < Rs 45 L |

Metro cities include:

- Delhi NCR

- Mumbai

- Bengaluru

- Chennai

- Hyderabad

- Kolkata

4. GST Calculation on Under-Construction Property

Land Deduction Rule

GST law mandates:

- 1/3rd of total property value = land

- GST applies only on 2/3rd value

Example – Non-Affordable Housing

- Agreement Value: Rs 60,00,000

- Taxable Value (2/3): Rs 40,00,000

- GST @ 5%: Rs 2,00,000

Total GST payable: Rs 2,00,000

Example – Affordable Housing

- Agreement Value: Rs 40,00,000

- Taxable Value (2/3): Rs 26,66,667

- GST @ 1%: Rs 26,667

5. Ready-to-Move-In Property

GST is NOT applicable if:

- Completion Certificate issued before sale

- Property is fit for occupation

Only the following apply:

- Stamp Duty

- Registration Charges

6. GST on Resale Residential Property

Resale means:

- Property already owned

- Sold by an existing owner

No GST applicable, even if:

- Property was once under construction

- Seller is a business entity

7. GST on Purchase of Land / Plot

GST not applicable on:

- Sale of land

- Sale of plot

Only stamp duty & registration apply

If land is sold along with construction services, GST applies on the construction portion.

8. GST on Construction Services

Builders pay GST on:

- Cement (28%)

- Steel (18%)

- Tiles, paint, fittings

- Architect & contractor services

However:

- Builders cannot pass ITC to buyers

- This cost is usually embedded in property price

9. GST on Renting of Residential Property (Major Impact Area)

A. Renting for Residential Use (Individual to Individual)

GST Exempt

Conditions:

- Tenant uses property for residence

- Tenant is not registered under GST

B. Renting to GST-Registered Person

GST applicable under Reverse Charge Mechanism (RCM)

| Particular | Details |

| GST rate | 18% |

| Who pays GST | Tenant |

| Landlord charger GST | No |

| ITC Available | Yes ( to tenant, if eligible ) |

Even if used for residence, GST applies if tenant is GST-registered.

C. Renting for Commercial Use

18% GST applicable

Examples:

- Guest house

- Paying Guest (PG)

- Service apartments

- Company-leased accommodation

10. GST on Maintenance Charges

Housing Society or RWA must charge GST if:

| Condition | Requirement |

| Monthly manitenance per flat | <Rs 7,500 |

| Annual turnover of society | <Rs 20 L |

GST Rate: 18%

If either condition is not met, GST is not applicable.

11. Other Charges Related to Residential Property

| Charge | GST Applicable |

| Stamp Duty | No |

| Registration Fees | No |

| Home Loan Processing Fee | Yes ( 18% ) |

| Legal /Documentation Fees | Yes |

| Parking ( if separately charged ) | Yes |

| Electricity ( government supply ) | No |

12. Input Tax Credit (ITC) – Why Buyers Don’t Get It

Under current GST rules:

- Buyers cannot claim ITC

- Builders also cannot pass ITC

- Lower GST rates (1% / 5%) were introduced in place of ITC

13. Compliance Responsibility

| Party | Responsibity |

| Builder | Collect & deposit GST |

| Buyer | Pay GST |

| Tenant ( RCM cases ) | Pay GST |

| Society | File GST return if applicable |

14. Advantages of GST in Real Estate

- Eliminated multiple indirect taxes

- Improved transparency

- Standardized tax structure

- Reduced tax cascading

15. Disadvantages / Concerns

- No ITC for buyers

- Increased cost for under-construction homes

- Complex rental GST compliance

Conclusion

- In 2026, GST on residential property in India:

- Applies only to under-construction properties

- Does not apply to completed, resale, or land purchases

- Has major implications on rentals

- Remains a critical factor in real-estate decision-making

FAQs – GST on Residential Property 2026

Q1. Is GST applicable on buying a house in 2026?

Only if it is under construction.

Q2. What is the GST rate on flats in 2026?

Affordable: 1%

Non-Affordable: 5%

Q5. Is GST applicable on home loan EMIs?

No, but processing fees attract GST.

Q7. Does GST apply on renting a house?

Individual tenant → No

GST-registered tenant → Yes (RCM)

Q8. Is GST applicable on parking charges?

Yes, if charged separately.

Q9. Is GST applicable on joint development agreements?

Yes, based on construction services.

Q10. Will GST rates change in 2026?

As of now, no official changes have been announced.

https://www.livehomes.in/blogs