.

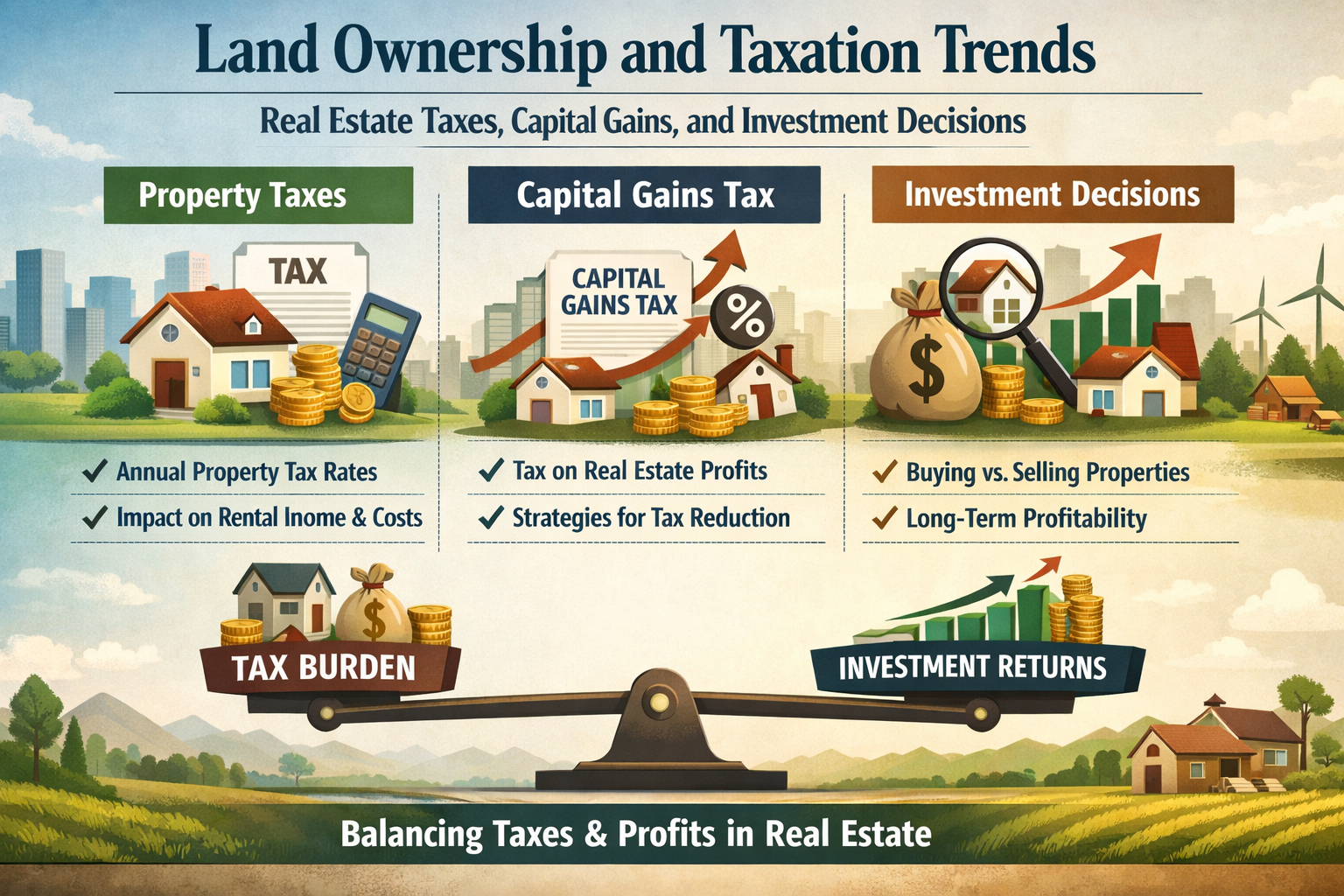

1. Introduction to Land Ownership and Taxation

Land ownership has historically been a foundation of wealth creation, economic stability, and political power. In modern economies, real estate remains one of the most significant asset classes, serving residential, commercial, agricultural, and industrial purposes. However, land ownership does not exist in isolation—it is deeply influenced by taxation systems designed to generate public revenue, regulate markets, and promote equitable development.

Taxation policies related to land and property directly affect:

- Affordability and access to land

- Investment incentives and disincentives

- Urban development and land use efficiency

- Wealth distribution and intergenerational equity

Understanding land ownership trends requires analyzing how property taxes, capital gains taxes, and related fiscal policies influence investor behavior and long-term market outcomes.

2. Real Estate Taxes: Structure and Economic Role

2.1 Property Taxes (Annual or Recurring Taxes)

Property taxes are recurring taxes levied by local or regional governments based on the assessed value of land and improvements (buildings). They are a primary revenue source for:

- Local governments

- Municipal services (schools, roads, police, fire services)

- Infrastructure development

Key Characteristics:

- Assessment-Based: Taxes depend on the estimated market value of the property.

- Recurring Obligation: Paid annually or semi-annually regardless of income generated.

- Location-Sensitive: Rates vary widely by jurisdiction.

Impact on Land Ownership:

- High property taxes can discourage long-term holding of underutilized land.

- They incentivize owners to develop or sell idle land to cover tax liabilities.

- Investors factor property taxes into net operating income (NOI) calculations.

2.2 Transaction Taxes (Stamp Duties and Transfer Taxes)

These taxes are imposed when property ownership changes hands.

Effects:

- Increase upfront costs for buyers

- Reduce transaction frequency

- Encourage long-term ownership rather than frequent trading

High transaction taxes can reduce market liquidity and slow urban development, especially in rapidly growing cities.

3. Capital Gains Tax in Real Estate

3.1 Definition and Scope

Capital gains tax (CGT) applies to the profit realized from selling property at a higher price than its purchase cost, adjusted for:

- Inflation

- Improvements

- Transaction costs

There are typically two categories:

- Short-term capital gains (higher rates, speculative deterrent)

- Long-term capital gains (lower rates, investment encouragement)

3.2 Influence on Investor Behavior

Capital gains taxation significantly shapes real estate investment strategies:

Holding Period Decisions:

- Lower long-term CGT rates encourage investors to hold property longer.

- Investors delay sales to qualify for tax benefits.

Market Timing:

- Anticipated tax reforms influence buying and selling cycles.

- Higher CGT discourages speculative flipping.

Portfolio Allocation:

- Investors may shift capital toward jurisdictions or asset classes with favorable tax treatment.

3.3 Tax Exemptions and Relief Measures

Governments often provide exemptions to achieve social or economic goals:

- Primary residence exemptions

- Agricultural land relief

- Reinvestment rollovers (e.g., deferring tax if proceeds are reinvested)

These policies strongly influence housing affordability, urban expansion, and rural land preservation.

Also Read: 2025 Real Estate Market Recap What Happened and What it Means for Buyers and Sellers

4. Combined Impact on Investment Decisions

4.1 Risk and Return Calculations

Real estate investors assess:

- Gross rental income

- Property taxes

- Maintenance and management costs

- Capital gains tax upon exit

Taxes reduce net returns, altering risk-adjusted performance compared to other asset classes like stocks or bonds.

4.2 Long-Term vs Short-Term Investment Strategies

| Strategy | Tax Influence |

| Buy and Hold | Favored by lower term CGT |

| Speculative flipping | Discouraged by high short term CGT |

| Rental Investment | Sensitive to property tex levels |

| Land Banking | Affected by recurring tax burden |

4.3 Urban vs Rural Investment Trends

- Urban Areas: Higher property values → higher tax burdens → pressure for efficient land use.

- Rural Areas: Lower taxes encourage agricultural and conservation ownership but may slow development.

5. Socioeconomic and Policy Implications

5.1 Wealth Inequality and Land Concentration

Tax policies influence whether land ownership becomes:

- Concentrated among wealthy investors

- Broadly distributed among households

Low capital gains taxes can amplify wealth accumulation for landowners, while progressive property taxes can mitigate inequality.

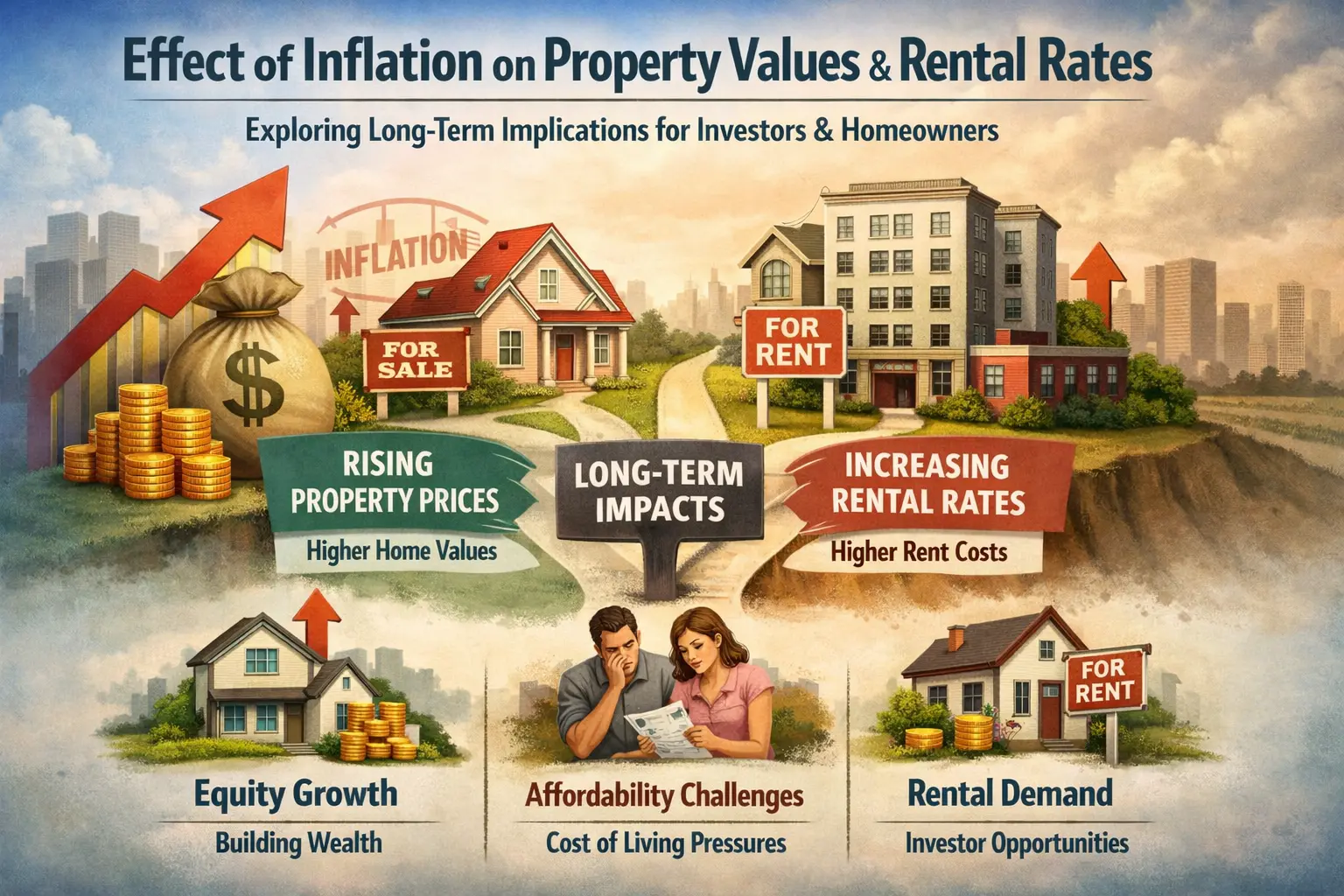

5.2 Housing Affordability

- High taxes may increase rental prices as landlords pass costs to tenants.

- Targeted tax relief for owner-occupied housing can improve affordability but reduce public revenue.

5.3 Sustainable Land Use and Development

Well-designed land taxation:

- Discourages speculation

- Encourages efficient land use

- Supports sustainable urban growth

Land value taxes, in particular, are increasingly discussed as tools to promote development without penalizing construction.

6. Global and Emerging Trends

6.1 Shift Toward Land Value Taxation

Some countries and cities are exploring taxes based solely on land value rather than improvements to:

- Reduce speculation

- Encourage construction

- Stabilize housing markets

6.2 Climate and Environmental Considerations

Tax incentives increasingly favor:

- Green buildings

- Conservation land

- Climate-resilient development

These influence long-term land ownership and investment priorities.

7. Conclusion

Land ownership and taxation are deeply interconnected forces shaping real estate markets and investment behavior. Property taxes influence holding costs and land use efficiency, while capital gains taxes shape investment horizons and market timing. Together, these taxes:

- Affect profitability and risk

- Guide investor decision-making

- Influence urban development and wealth distribution

Effective land taxation policy balances revenue generation, economic efficiency, and social equity, ensuring that land remains a productive asset rather than a speculative tool.

https://www.livehomes.in/live_insights