The introduction of the Goods and Services Tax (GST) in July 2017 was a game-changer for many industries, and real estate was no exception. Before GST, the property sector was tangled in multiple indirect taxes like VAT, Service Tax, Excise Duty, and Stamp Duty (which still exists). This lack of clarity often created confusion between builders and buyers, leading to mistrust and disputes. Today, with GST streamlining most of these taxes into a single framework, the real estate sector has moved towards greater transparency, simplified taxation, and fairer pricing structures. But how has this shift impacted both builders and buyers?

1. Before GST: A Tax Maze

Earlier, homebuyers purchasing under-construction properties were charged a mix of Service Tax and VAT, which varied from state to state. Builders, on the other hand, struggled to manage multiple tax filings, compliance requirements, and hidden levies on construction materials like cement, steel, and fittings.

- Buyers often complained that they didn’t know the exact breakup of taxes.

- Builders found it difficult to claim credit for taxes already paid on materials, which inflated the property cost.

-This lack of clarity made real estate one of the least transparent sectors in India.

2. After GST: One Nation, One Tax

GST replaced most indirect taxes with a uniform system:

- Under-construction properties attract GST at 5% (without Input Tax Credit) for normal housing and 1% for affordable housing.

- Ready-to-move properties are exempt from GST, which gives buyers an incentive to purchase completed homes.

- Commercial properties such as offices and shops also fall under GST, ensuring clear and consistent tax treatment.

- This structure has reduced confusion and given buyers a straightforward understanding of how much tax they’re paying.

Also Read: What is GST on the basis of buying a property

3. Impact on Builders

- Simplified compliance: Instead of dealing with multiple taxes, builders now file GST returns under a single system.

- Reduced cost of construction materials: Many raw materials fall under GST, which reduced cascading taxes. However, since ITC (Input Tax Credit) is not allowed on residential projects, builders cannot fully benefit.

- Market competitiveness: With transparent tax rates, builders must now compete based on quality, delivery, and amenities rather than hidden cost advantages.

4. Impact on Buyers

- Clarity in pricing: Buyers now know the exact GST rate they’re paying without hidden taxes.

- Cheaper ready-to-move homes: Since completed projects attract no GST, many buyers prefer them, pushing developers to speed up construction and hand over projects faster.

- Confidence in transactions: Transparency builds trust, which is crucial in a sector where many customers invest their life savings.

5. Builders vs. Buyers: Bridging the Trust Gap

The GST regime has created a balance of power:

- Buyers are more informed and can calculate the total cost of ownership more clearly.

- Builders, though slightly squeezed on margins due to loss of ITC, are forced to maintain transparency, timely project completion, and competitive pricing.

- Overall, the sector is moving towards customer-first practices, which is a long-term positive.

Also Read: GST for ready to occupy and under construction flats

6. Challenges Ahead

Despite improvements, some challenges remain:

- Non-availability of ITC in residential projects makes it tough for builders to control costs.

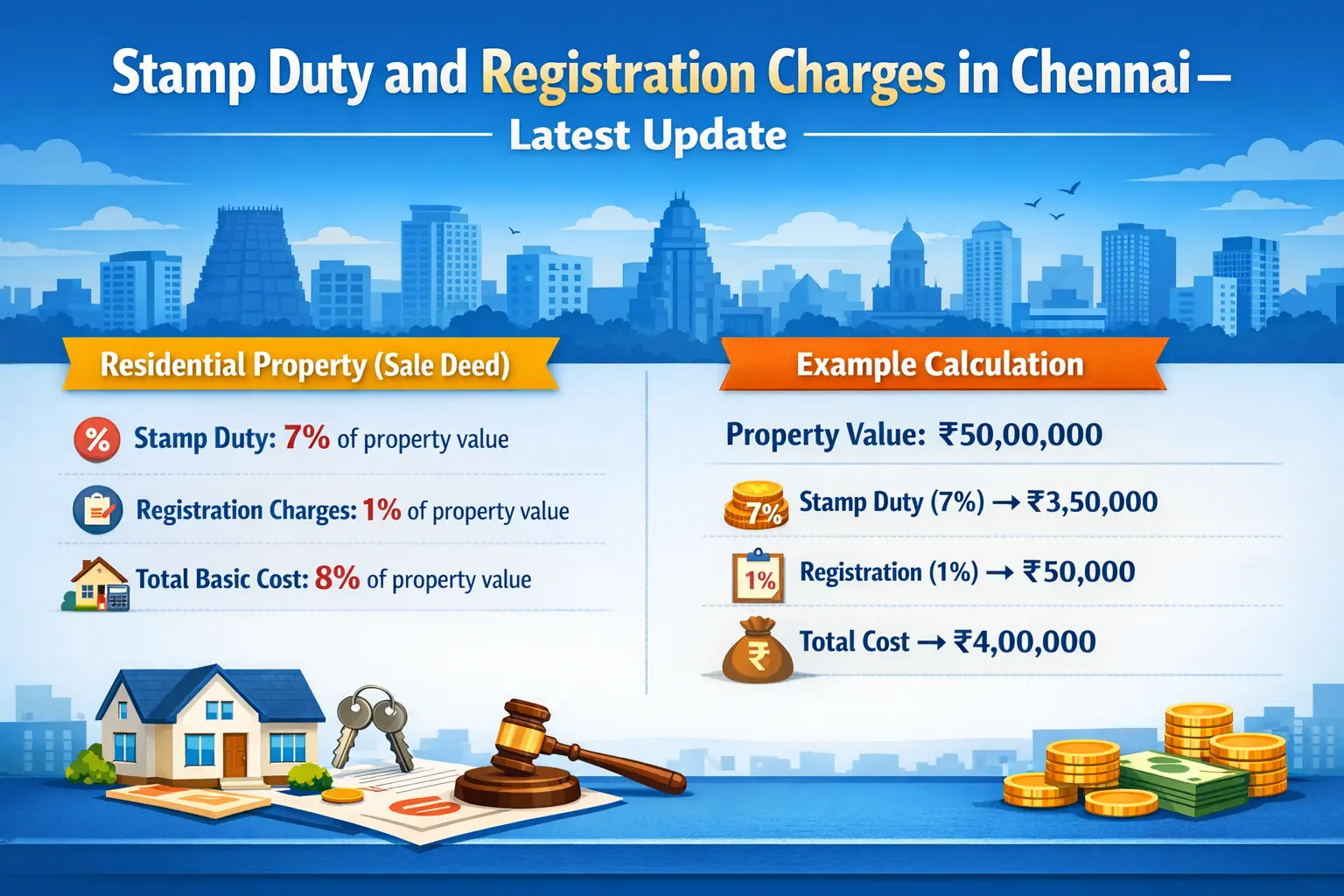

- Stamp Duty, which is outside GST, still adds a significant expense for buyers.

- Lack of awareness among many homebuyers about GST rules sometimes leads to confusion.

7. The Future of GST in Real Estate

Experts believe that with further reforms—like integrating Stamp Duty under GST or restoring ITC for builders—the sector could become even more transparent and affordable. This would benefit both sides, ensuring fairer pricing for buyers and sustainable growth for builders.

Conclusion

GST has undoubtedly changed the dynamics between builders and buyers. While builders are adapting to stricter transparency norms, buyers are enjoying greater clarity and trust in their transactions. Though challenges remain, GST has laid the foundation for a more structured, honest, and buyer-friendly real estate market in India.

https://www.livehomes.in/blogs