Chennai’s real estate market enters 2026 on a strong and structurally stable footing, supported by diversified demand drivers, disciplined supply additions, and sustained infrastructure development. Unlike more volatile metropolitan markets, Chennai continues to demonstrate resilience through steady absorption, controlled vacancy levels, and balanced growth across asset classes. The year ahead is expected to consolidate these trends rather than disrupt them, positioning the city as one of India’s most predictable and investment-friendly real estate markets.

Commercial Real Estate Outlook 2026

Continued Dominance of GCC-Led Office Demand

The commercial office market in Chennai is expected to remain primarily demand-driven in 2026, with Global Capability Centres (GCCs) continuing to act as the principal growth engine. Multinational firms are increasingly viewing Chennai as a long-term strategic base rather than a cost-arbitrage location, resulting in larger office footprints, longer lease tenures, and higher-quality space requirements.

Demand is likely to be skewed toward:

- Grade A office developments

- Technology-enabled campuses

- Sustainable and energy-efficient buildings

This structural shift will sustain healthy net absorption levels, even as traditional IT and IT-enabled services maintain a more cautious expansion approach.

Tight Supply Conditions and Low Vacancy

Chennai’s disciplined development pipeline will remain a defining strength in 2026. New supply additions are expected to stay moderate, preventing oversupply risks seen in other metro markets. With net absorption projected to outpace completions, vacancy rates are likely to remain in the single-digit range.

This supply-demand imbalance will:

- Strengthen landlord negotiating power

- Support rental stability and gradual escalation

- Reduce speculative development risks

Chennai’s status as the only major metro with consistently low vacancy reinforces its appeal to institutional investors and long-term occupiers.

Rental Growth and Asset Value Appreciation

Office rentals are expected to register steady, incremental growth in 2026 rather than sharp spikes. This controlled appreciation enhances Chennai’s attractiveness as a yield market, especially for investors seeking stable returns rather than short-term capital gains.

Capital values are also expected to firm up, supported by:

- Rising occupancy levels

- Long-term leasing commitments

- Increased interest in core and core-plus assets

Expansion Beyond the Core City

While established office corridors will continue to attract bulk leasing, secondary markets and peripheral zones are expected to gain momentum. Improved road networks, metro expansion, and availability of large land parcels will drive interest in emerging submarkets, easing pressure on core business districts.

Residential Real Estate Outlook 2026

End-User–Driven Market Stability

Chennai’s residential market is fundamentally end-user-driven, a characteristic that will continue to define its performance in 2026. Unlike speculative-heavy markets, housing demand is anchored by employment stability, urban migration, and lifestyle upgrades.

Homebuyers are expected to remain cautious but committed, prioritizing:

- Project credibility

- Construction quality

- Location connectivity

- Value-for-money pricing

This ensures steady absorption without excessive price volatility.

Price Growth Supported by Cost Pressures

Residential prices in Chennai are likely to witness moderate appreciation in 2026. Rising input costs, higher land prices in prime corridors, and compliance-related expenses will push developers toward calibrated price increases.

However, affordability will remain largely intact due to:

- Phased price hikes

- Flexible payment plans

- Continued availability of mid-segment housing

Luxury and premium housing may see relatively stronger appreciation, driven by demand from senior professionals, entrepreneurs, and returning non-resident buyers.

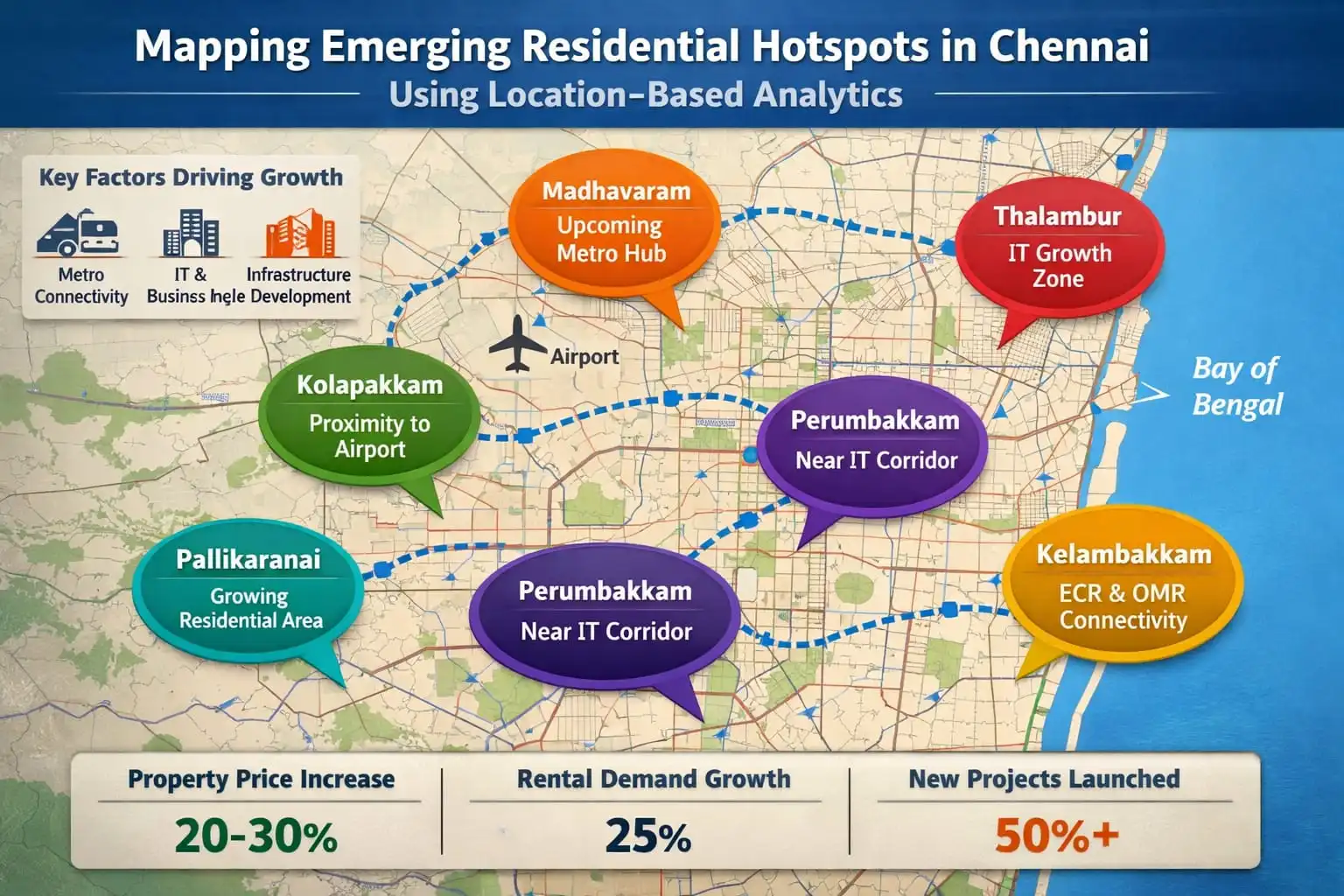

Micro-Market Differentiation

Residential performance in 2026 will increasingly depend on micro-market fundamentals rather than city-wide trends. Areas with strong job proximity, infrastructure upgrades, and social amenities will outperform.

Key growth drivers include:

- Metro rail connectivity

- Peripheral road development

- Integrated township projects

Suburban and peripheral zones are expected to attract first-time buyers, while central and established neighborhoods will see demand from upgraders.

Rental Housing Momentum

Rental demand is expected to remain robust, driven by office return-to-work trends, inward migration, and the growing preference for flexible living. This will support stable rental yields, particularly in locations close to employment hubs.

Industrial, Logistics, and Data Centre Spillover Effects

Chennai’s expanding industrial base, logistics parks, and data centre activity will indirectly strengthen both commercial and residential real estate in 2026. Increased employment generation in manufacturing, electronics, and digital infrastructure will fuel housing demand in adjacent corridors and support commercial ancillary developments.

Tier-II cities within Tamil Nadu will increasingly complement Chennai’s growth, reducing pressure on the metro while expanding the overall real estate ecosystem.

Investment Sentiment and Market Risks

Positive Investor Outlook

Institutional and long-term investors are expected to maintain strong interest in Chennai due to:

- Predictable returns

- Low vacancy risks

- Stable regulatory environment

The city’s balanced growth model aligns well with long-horizon investment strategies.

Key Watch Factors

While the outlook remains positive, stakeholders will monitor:

- Global economic conditions impacting corporate expansion

- Interest rate movements affecting homebuyer sentiment

- Pace of infrastructure execution

However, Chennai’s diversified demand base and conservative development practices provide a strong buffer against external shocks.

Conclusion: A Market Built for Consistency, Not Volatility

In 2026, Chennai’s real estate market is poised to deliver consistency over exuberance. Commercial real estate will continue to benefit from strong occupier demand, tight supply, and rental stability, while the residential sector will grow steadily on the back of genuine end-user demand and improving urban infrastructure. Rather than chasing rapid growth, Chennai is strengthening its reputation as a low-risk, high-confidence real estate market, making it increasingly attractive to occupiers, homebuyers, and investors seeking long-term value and stability.

https://www.livehomes.in/live_insights