Real estate transactions involve high financial value and legal responsibility. When a buyer and seller enter into a property deal, both parties expect security, trust, and transparency. But in reality, there is always a risk—what if the buyer pays and the seller doesn’t transfer the property? Or what if the seller hands over documents and the buyer delays payment? To solve this issue, the real estate industry uses a trusted method called Escrow.

What Is Escrow in Real Estate?

Escrow is a secure arrangement where a neutral third party holds money, documents, or property until both the buyer and seller fulfill all the terms of a property transaction. This neutral party is known as the escrow agent.

In simple words, escrow acts like a safety locker where the buyer’s payment and the seller’s documents are safely held until the deal is completed legally and fairly. This prevents cheating and builds trust in the real estate transaction.

How Escrow Works – Simple Explanation

To help you understand easily, imagine this situation:

- You are buying a house. You don’t want to give full payment until you are sure the property legally belongs to you. At the same time, the seller doesn’t want to hand over original property documents until he receives the money. So, both of you agree to use an escrow service.

- You deposit the payment into a secure escrow account instead of giving it to the seller directly.

- The seller submits the original property documents to the escrow agent.

- The escrow agent verifies everything legally.

- When both sides have completed their responsibilities, the escrow agent safely transfers the money to the seller and the documents to you.

- The property is registered in your name, and the transaction gets completed without risk.

Who Is an Escrow Agent?

An escrow agent is a trusted third party who manages the escrow process. Escrow agents can be:

- Licensed escrow companies,

- Banks,

- Real estate attorneys,

- Chartered accountants,

- Financial institutions,

- And in some cases, government-regulated bodies like under RERA in India.

The role of the escrow agent is to remain neutral. They cannot support either the buyer or the seller. Their only responsibility is to ensure the agreement terms are followed properly.

Why Escrow Is Important in Real Estate

Escrow plays a major role in property transactions for the following reasons:

It prevents fraud and cheating. The seller cannot run away with money without giving documents, and the buyer cannot delay payment after receiving ownership details. It builds trust between both parties and ensures a transparent and fair transaction. Escrow also ensures legal safety by verifying documents, ownership history, pending dues, taxes, or legal disputes. Because of escrow, disputes and misunderstandings are reduced during property deals.

Escrow in Indian Real Estate and RERA Regulation

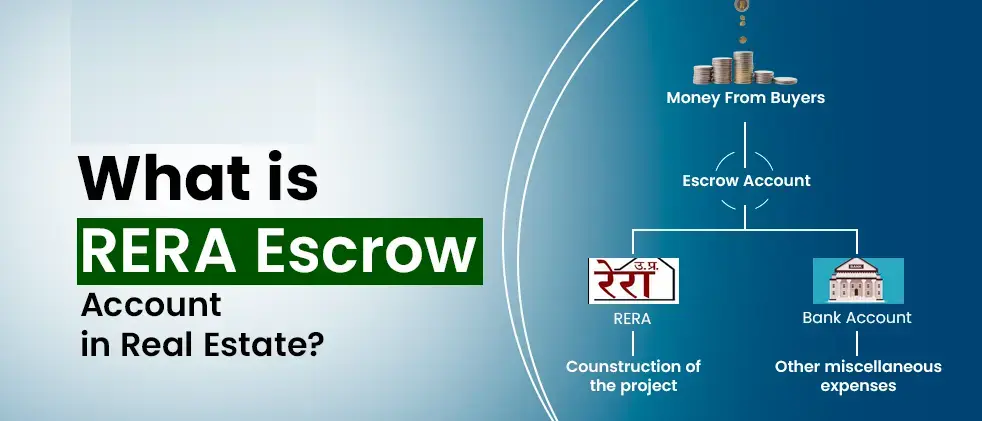

In India, escrow has become more popular and legally structured after RERA (Real Estate Regulatory Authority) was introduced. RERA made escrow mandatory for all builders and developers who construct residential or commercial projects.

According to RERA law, builders must deposit 70% of the money collected from homebuyers into a separate escrow account. This money can only be used for the construction of that specific project. This prevents builders from using customer money for other projects or business purposes and protects homebuyers from delay or fraud.

When Is Escrow Used in Real Estate?

Escrow is not only used while buying or selling a property. It is also used in many other situations such as:

- Buying a ready-to-move or resale property

- Under-construction property purchases

- Home loan disbursement where banks use escrow accounts

- Real estate joint ventures

- NRI property deals

- Dispute settlements over property

- Lease-to-own property agreements

Step-by-Step Escrow Process

The escrow process in a real estate transaction happens in multiple stages:

First, the buyer and seller agree to terms and sign a sale agreement. Then, the buyer deposits an advance or full payment into the escrow account. The seller submits original property documents to the escrow agent. After that, the verification process begins. The escrow agent checks the property title, legal approvals, encumbrance details, tax receipts, bank loans, and government permissions. If legal checks are satisfactory, the bank (if involved) releases funds through escrow. Once all conditions are met, the escrow agent releases the payment to the seller and hands over the property documents to the buyer. Finally, the sale deed is registered, and the buyer becomes the official owner of the property.

Benefits of Escrow for Buyers and Sellers

With escrow, buyers feel secure because their money is not misused. Sellers also benefit because they receive guaranteed payment once formalities are complete. Escrow increases transparency in real estate and ensures professional handling of funds and documents. It protects both parties from fraud and legal complications and encourages smooth transactions in high-value property deals.

Challenges of Escrow

Although escrow is a safe method, it can sometimes take time due to document verification and legal checks. There are also escrow service charges involved, which vary depending on the value of the transaction. Some people are not familiar with escrow, especially in rural or small-town real estate markets, so awareness is still growing.

Conclusion

Escrow in real estate is a secure and trusted system that protects both buyers and sellers during property transactions. It ensures that money and documents are exchanged only when both sides meet their agreed responsibilities. In India, escrow services have become stronger and more regulated after RERA, especially in under-construction projects.

https://www.livehomes.in/blogs