When buying a property in India, one of the most important cost components to understand is GST (Goods and Services Tax). Since its implementation in 2017, GST has simplified multiple indirect taxes into a single tax system, but for real estate buyers, it still raises many questions—especially regarding rates, exemptions, and how it impacts the final property cost.

1. What is GST in Real Estate?

GST is a single tax on the supply of goods and services, including the construction of properties. In real estate, GST primarily applies to under-construction properties and is payable by the buyer to the builder or developer. It does not apply to the purchase of completed properties or resale transactions.

.

2. Applicability of GST on Property Purchases

- GST is applicable in the following scenarios:

- Under-construction properties purchased from a developer.

- Commercial properties (shops, offices) sold before completion.

- Plots with construction services provided by the developer.

GST is not applicable when:

- You buy a ready-to-move-in property.

- You buy a resale property from an individual (secondary market).

- You buy land without any construction agreement.

3. GST Rates on Property Purchase (as per April 2019 revisions)

The government revised GST rates to make housing more affordable:

Affordable housing definition (as per GST rules):

- Metro cities: Carpet area up to 60 sq.m. and value up to ?45 lakh.

- Non-metro cities: Carpet area up to 90 sq.m. and value up to ?45 lakh.

4. GST on Ready-to-Move-In vs Under-Construction Properties

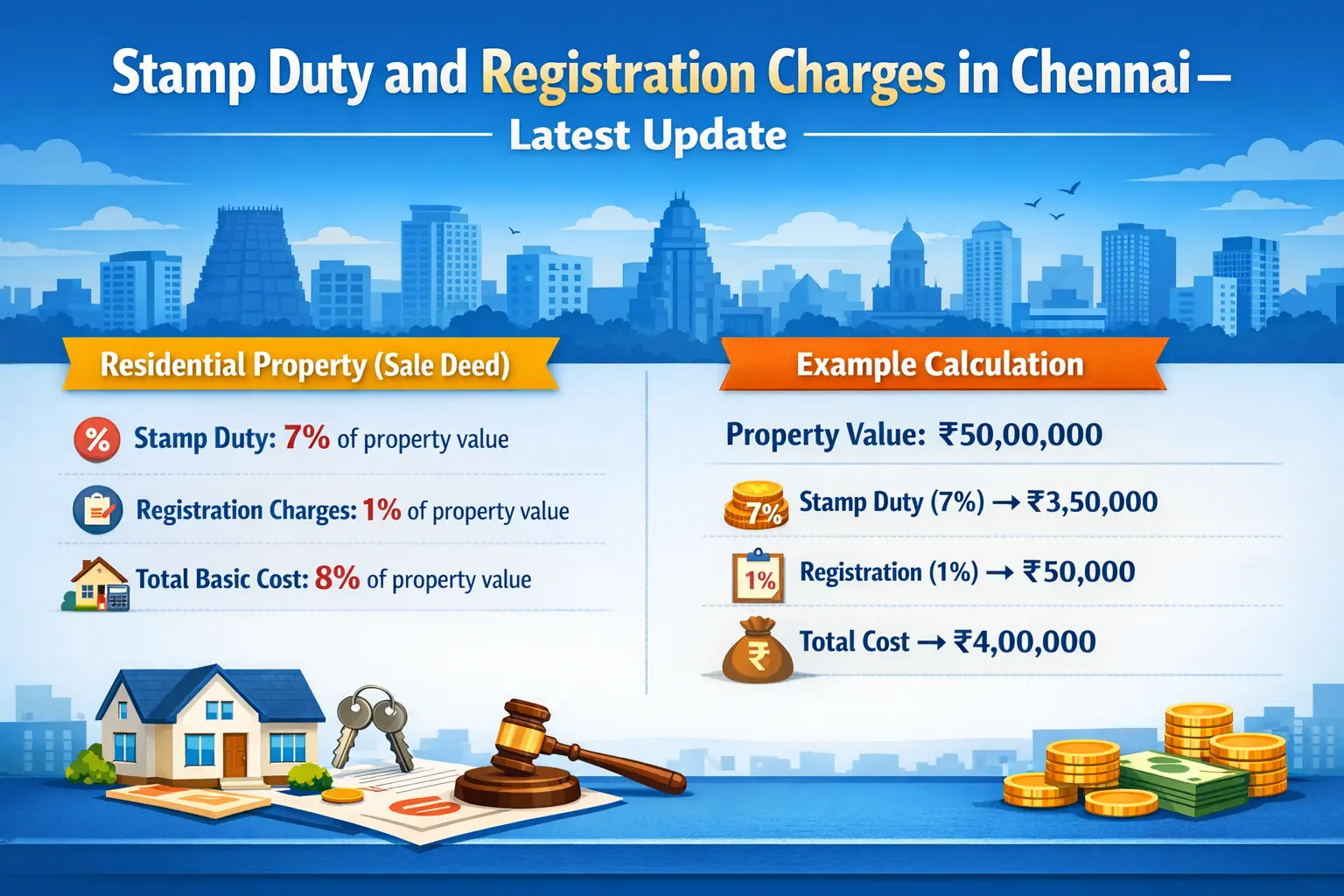

- Ready-to-move-in: No GST. You only pay registration charges and stamp duty.

- Under-construction: GST applies at the applicable rate (1% or 5%), plus registration and stamp duty.

5. How GST Impacts Your Property Cost

Let’s take an example:

If you’re buying a non-affordable under-construction flat worth ?60 lakh:

- GST = ?60,00,000 × 5% = ?3,00,000.

- Total cost before stamp duty/registration = ?63,00,000.

Earlier, under the pre-2019 regime, GST was 12% with ITC (input tax credit), which meant buyers could claim some tax benefit. Now, the lower rates come without ITC, so developers can’t offset their construction costs via GST credits, but buyers pay less upfront tax.

6. GST on Commercial Property Purchases

For commercial units under construction, GST is charged at 12% with ITC. This allows business buyers to claim credit for GST paid, which can be adjusted against their GST liabilities.

7. Other Charges under GST

Apart from the property cost, GST also applies to certain allied services:

- Clubhouse fees

- Maintenance charges (above ?7,500/month per flat)

- Parking space charges

- Preferential location charges (PLC)

8. GST on Joint Development Agreements

When a landowner and developer enter a joint development agreement (JDA), GST applies on:

- The transfer of construction services from developer to landowner.

- Sale of flats to third-party buyers during construction.

9. Key Points for Homebuyers

- Always check if your property is ready-to-move-in or under construction.

- Confirm whether GST is included in the price quoted by the builder.

- Affordable housing attracts only 1% GST—significantly reducing costs.

- GST is in addition to stamp duty and registration fees.

Conclusion

Understanding GST on property purchases helps you plan your budget better and avoid last-minute surprises. In short:

- Ready-to-move-in → No GST.

- Under-construction → 1% (affordable) or 5% (non-affordable) without ITC.

- Commercial under construction → 12% with ITC.

- If you’re purchasing a home, always ask your builder for a GST-inclusive price and keep a copy of the GST invoice for your records.

https://www.livehomes.in/blogs