City Context

Chennai is one of India’s most stable real estate markets. Unlike highly speculative cities, Chennai’s property prices are driven largely by end-user demand, employment growth, and infrastructure development. This has resulted in steady, predictable appreciation rather than sharp booms and crashes.

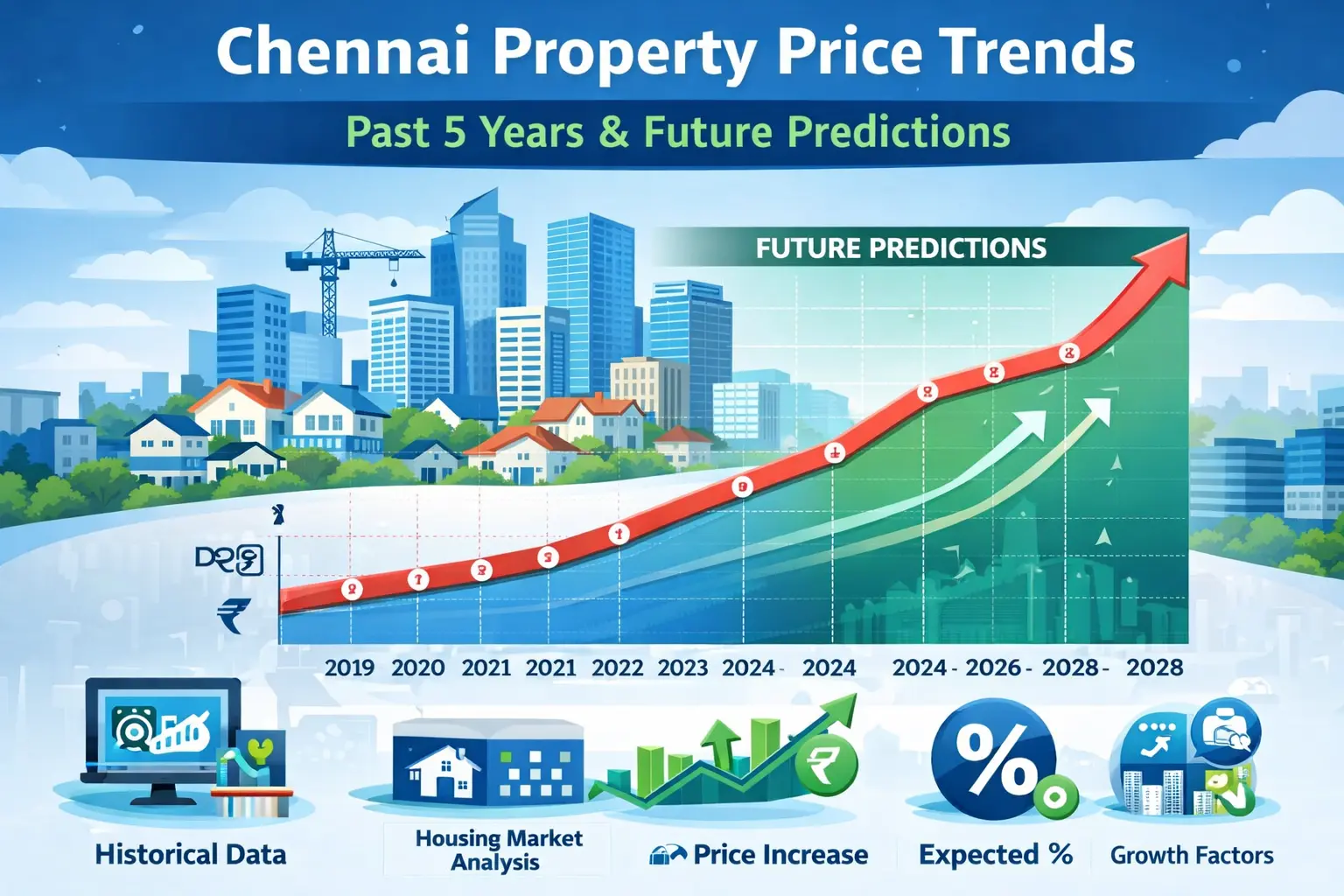

Part 1: Chennai Property Price Trends – Past 5 Years (2021–2026)

Overall Market Movement

From 2021 to 2026, Chennai property prices have shown consistent upward growth, averaging 4%–7% annually, with stronger growth after 2023 due to economic recovery, infrastructure momentum, and increased housing demand.

Key Characteristics of the Last 5 Years

- No major price crash, even during slower economic periods

- Demand led mainly by homebuyers (not short-term investors)

- Gradual rise in construction costs pushed base prices upward

- Premium and well-connected locations outperformed the average

Year-by-Year Trend Explanation

2021

- Market was recovering from pandemic impact

- Prices largely remained stable with minimal appreciation

- Buyers focused on ready-to-move and low-risk projects

Price movement: Mostly flat to +2%

2022

- Demand revived due to low home-loan interest rates

- Increased preference for larger homes and gated communities

- Peripheral and suburban areas saw higher interest

Price movement: +3% to +4%

2023

- Strong revival in sales volumes

- Construction costs increased (cement, steel, labour)

- Developers revised prices upward gradually

Price movement: +4% to +6%

2024

- One of the strongest years for Chennai real estate

- Significant demand in IT corridors and residential hubs

- Average city-level prices crossed ?7,000 per sq. ft

Price movement: +6% to +8%

2025–2026

- Continued momentum with stable absorption

- Premium housing and well-connected suburbs performed better

- Infrastructure developments strengthened buyer confidence

Price movement: +5% to +7%

Location-Wise Price Movement (Past 5 Years)

1. Core & Premium Areas

- Examples: Anna Nagar, Adyar, Besant Nagar

- Already high base prices

- Limited new supply

- Strong resale and rental demand

5-year appreciation: ~30%–40%

Current range (2026): Rs 14,000 - Rs 18,000+ per sq. ft

2. IT & Growth Corridors

Examples: OMR, Sholinganallur, Siruseri, Perungudi

- Driven by IT employment and office expansion

- Continuous new residential supply

- Good balance of price and demand

5-year appreciation: ~35%–45%

Current range (2026): Rs 7,000 – Rs 9,500 per sq. ft

3. Emerging & Suburban Zones

Examples: Tambaram, Medavakkam, Porur, Pallavaram

- Benefited from road, rail, and metro connectivity

- Strong demand from middle-income buyers

- Higher growth potential due to lower base prices

5-year appreciation: ~40%–50%

Current range (2026): Rs 4,500 - Rs 7,500 per sq. ft

Part 2: Factors That Drove Prices in the Past 5 Years

1. End-User Driven Market

Most buyers in Chennai purchase homes to live in, not for speculation. This kept prices realistic and stable.

2. Infrastructure Development

Metro expansion, road upgrades, and suburban rail improvements increased demand along connectivity corridors.

3. Job Market Stability

IT, manufacturing, automobile, and services sectors ensured steady housing demand.

4. Controlled Supply

Developers avoided overbuilding, which prevented oversupply-led price stagnation.

Part 3: Future Price Predictions (2026–2030)

Overall Forecast

Chennai property prices are expected to continue moderate and steady growth, averaging:

5%–7% annual appreciation

This growth is expected to be sustainable, not speculative.

Future Outlook by Location Type

Core City Areas

- Limited land availability

- High replacement cost

- Strong resale demand

Expected growth: 4%–6% annually

Future range: Rs 17,000 - Rs 20,000+ per sq. ft

IT Corridors & Employment Zones

- Continued office expansion

- Strong rental demand

- Metro connectivity impact

Expected growth: 6%–8% annually

Future range: Rs 9,000 – Rs 12,000 per sq. ft

Suburban & Peripheral Areas

- Maximum upside potential

- Infrastructure-led appreciation

- Affordable entry prices

Expected growth: 7%–9% annually

Future range: Rs 6,000 – Rs 10,000 per sq. ft

Part 4: Key Drivers of Future Price Growth

1. Infrastructure Expansion

Improved transport connectivity will continue to push demand outward from the city core.

2. Rising Construction Costs

Land, material, and labour costs will keep base prices firm.

3. Stable Buyer Demand

Housing demand from professionals, families, and NRIs will support long-term appreciation.

4. Regulatory Transparency

Stronger buyer protection and financial discipline increase confidence and market stability.

Conculsion

Past 5 Years (2021–2026)

- Stable appreciation of ~4%–7% annually

- Stronger growth in IT corridors and suburbs

- Minimal volatility compared to other metros

Future (2026–2030)

- Continued steady growth, not speculative spikes

- Suburban and infrastructure-linked areas likely to outperform

- Core city areas remain premium and stable

https://www.livehomes.in/live_insights