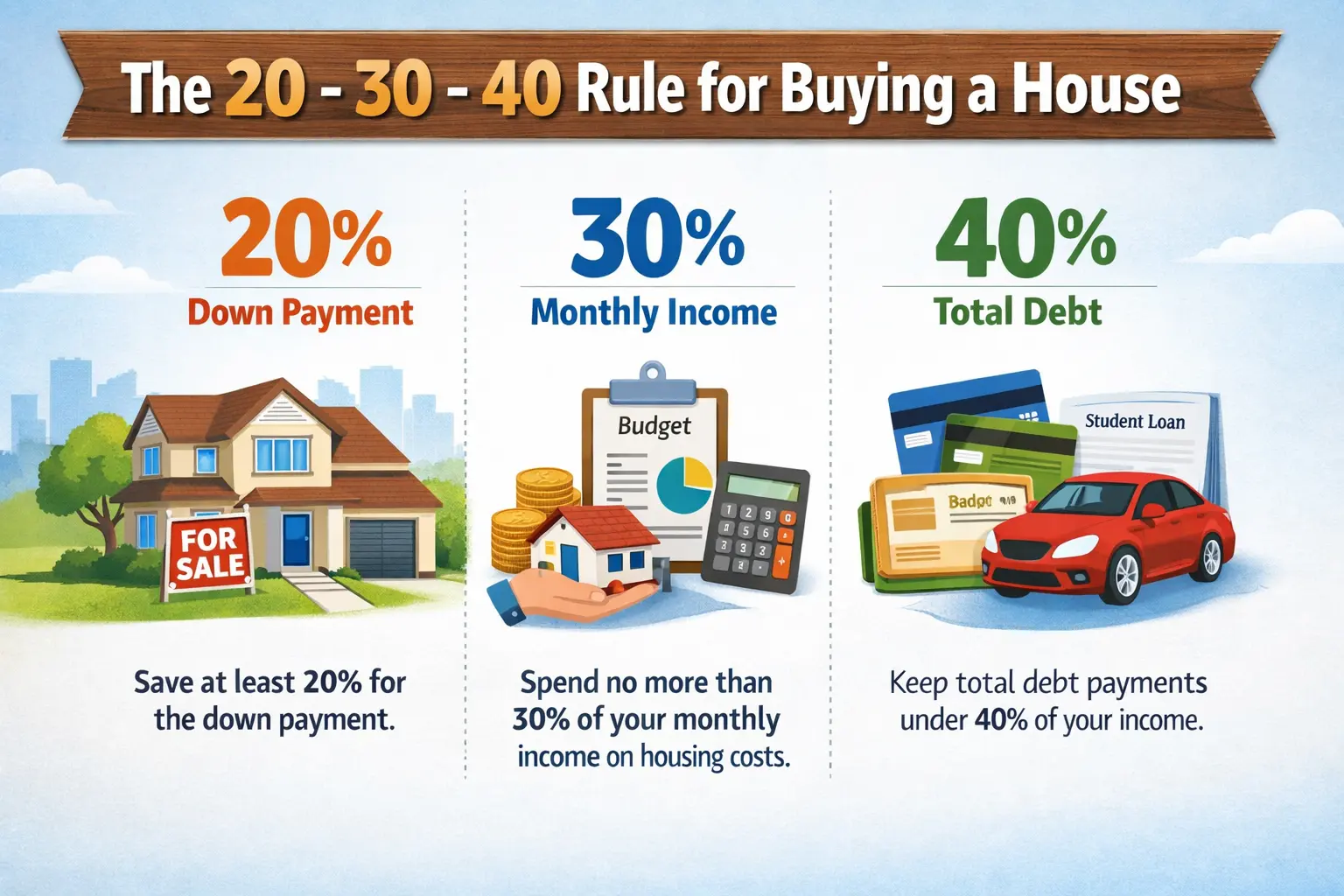

1. What Is the 20/30/40 Rule?

The 20/30/40 rule is a personal financial planning framework that helps you decide how much house you can safely afford in India without damaging your long-term financial health.

It is NOT:

- An RBI rule

- A bank guideline

- A legal requirement

It IS:

- A safety-based affordability rule

- Designed for long-term EMI stability

- Especially useful in India due to floating interest rates and long loan tenures

2. Meaning of Each Number in the Rule

| Number | Meaning | What it Controls |

| 20% | Down Payment | Controls loan size & Interest burden |

| 30% | Housing EMI limit | Controls montly cash flow |

| 40% | Total EMI limit | Controls overall debt stress |

Each part protects you from a different financial risk.

3. The 20% Down Payment Rule (Explained in Detail)

3.1 What Does 20% Mean?

You should ideally pay at least 20% of the property value from your own funds (savings, investments, etc.).

Example

- Property price: ?70 lakh

- Minimum down payment (20%): ?14 lakh

- Home loan: ?56 lakh

3.2 Why 20% Is Important in India

(a) Bank Loan Limits

Most Indian banks:

- Finance 75–80% of property value

- Charge higher interest if loan >80%

Paying 20% keeps you in the lowest-risk category.

(b) Interest Cost Reduction

Long home loan tenures (20–30 years) mean:

- Interest paid can exceed principal

- Even small loan increases cost lakhs more

Paying 20% upfront can save Rs 20–40 lakh in interest over time.

(c) Protection Against Price Stagnation

Indian property prices:

- Do not always rise

- Can remain flat for years

A 20% down payment:

- Protects you from negative equity

- Gives flexibility to sell or refinance

3.3 Hidden Costs (Very Important in India)

Many buyers make mistakes here.

| Expense | Approx Cost |

| Satmp Duty | 5 - 8% |

| Registration | 1-2% |

| GST ( under construction ) | 5% |

| Legal & Loan charges | 0.5 - 1 % |

| Interior & Furniture | 5 - 10% |

4. The 30% Housing EMI Rule (Detailed)

4.1 What Does 30% Mean?

Your total monthly housing cost should not exceed 30% of your gross monthly income.

Housing Cost Includes:

- Home loan EMI

- Maintenance charges

- Society charges

- Property tax (if paid monthly)

4.2 Why 30% Is Safe in India

(a) Floating Interest Rates

Indian home loans:

- Are mostly floating rate

- EMI can increase anytime

A loan affordable at 8% may become stressful at 10%.

(b) Life Expenses Keep Increasing

- School fees

- Medical costs

- Family responsibilities

Keeping EMI ≤30% ensures flexibility.

4.3 Example Calculation

- Monthly income: Rs 1,00,000

- Max housing EMI (30%): Rs 30,000

This EMI level remains manageable even if rates rise.

4.4 Banks vs Real Life

| EMI % | Bank View | Reality |

| 50 - 60% | Approved | Financial Stress |

| 40 % | Acceptable | Risky |

| 30 % | Ideal | Sustainable |

Bank approval does NOT mean affordability

Also Read: Did You Know Different Between Home Loan and Land Loan

5. The 40% Total EMI Rule (Most Critical)

5.1 What Does 40% Mean?

Your total monthly EMIs (all loans combined) should not exceed 40% of your gross income.

5.2 What Is Included in 40%?

- Home loan EMI

- Car loan EMI

- Personal loan EMI

- Education loan EMI

- Credit card EMI

5.3 Why 40% Is the Upper Limit

Indian households face:

- Job loss risk

- Medical emergencies

- Unexpected family expenses

Crossing 40%:

- Leaves no emergency buffer

- Damages credit score

- Increases default risk

5.4 Example

Monthly income: Rs 1,20,000

| Loan | EMI |

| Home Loan | RS 36,000 |

| Car Loan | Rs 8,000 |

| Personal Loan | Rs 4,000 |

| Total | Rs 48,000 ( 40 % ) |

This is the maximum safe limit.

6. Full Combined Example (Start to Finish)

Buyer Profile

- Monthly income: Rs 1,50,000

- Existing EMI: Rs 10,000

Step 1: Housing EMI Limit (30%)

Rs 1,50,000 × 30% = Rs 45,000

Step 2: Total EMI Limit (40%)

Rs 1,50,000 × 40% = Rs 60,000

Remaining EMI capacity = Rs 50,000

But housing EMI must stay ≤ Rs45,000.

Step 3: Loan Eligibility

At 9% interest for 20 years:

- Rs 45,000 EMI ≈ Rs 47–50 lakh loan

Step 4: Property Budget

- Loan: Rs 50 lakh

- Down payment (20%): Rs 12.5 lakh

- Safe property price ≈ Rs 62–65 lakh

7. Tax Benefits (Important but Overrated)

| Section | Maximum Benefits |

| 80C | Rs 1.5 Lakh |

| 24 ( b ) | Rs 2 lakh |

| 80EEA | Extra Rs 1.5 lakh |

Tax benefits do not reduce EMI, only tax outflow.

Never stretch your budget assuming tax savings.

8. When Can You Slightly Bend the Rule?

| Situation | Flexibility |

| Dual Income | Slight |

| High Income | Slight |

| Rental Income | Careful |

| Variable Income | No |

| Single Income | Strict |

9. Who Should Follow It Strictly?

- First-time buyers

- Single earners

- Salaried professionals

- Middle-income families

- Buyers in unstable job sectors

10. Conclusion

- The 20/30/40 rule helps you buy a house without sacrificing financial peace.

- It focuses on long-term comfort, not just loan approval.

- A house should improve your life, not control it.

FAQs – 20/30/40 Rule in India

Q1. Is the 20/30/40 rule compulsory?

No. It is a financial safety guideline, not a law.

Q2. Should income be taken before or after tax?

Always gross income.

Q3. Can bonuses be included?

No. Use only fixed income.

Q4. Can I take a loan with EMI above 30%?

Yes, but it increases financial risk.

Q5. Does this apply to joint home loans?

Yes, based on combined income.

Q6. Can I depend on future salary growth?

No. EMIs are fixed; income is uncertain.

Q7. Is 40% EMI conservative?

No. It protects against emergencies and job loss.

https://www.livehomes.in/blogs