Investing in real estate is a popular and time-tested strategy, especially in countries like India. But when it comes to buying flats or apartments, there are both benefits and drawbacks. Whether it’s a good or bad investment depends on your financial goals, location, and time frame.

Pros of Buying Flats/Apartments for Investment

1. Steady Rental Income

-

Flats in cities or near business hubs (like IT parks, colleges, hospitals) can provide regular rental income.

-

A 2BHK apartment in a prime location can easily earn ?15,000–?40,000 per month depending on the city and amenities.

2. Affordability Compared to Independent Houses

-

Flats are generally more affordable than villas or individual homes in the same locality.

-

Ideal for first-time investors or those with a mid-range budget.

3. High Demand in Urban Areas

-

Urban population growth drives demand for compact and secure housing.

-

Flats are especially attractive to nuclear families, working professionals, and students.

4. Amenities and Infrastructure

-

Most modern apartments come with facilities like:

-

24/7 security

-

Power backup

-

Gym, pool, clubhouse

-

Maintenance staff

-

-

These increase rental and resale value.

5. Tax Benefits on Home Loans

-

You can claim tax deductions on both:

-

Principal repayment under Section 80C

-

Interest paid under Section 24(b)

-

6. Easier to Sell or Rent

-

Flats are generally easier to rent out or resell than land or houses, especially in well-developed gated communities.

Cons of Buying Flats/Apartments for Investment

1. Depreciation of Structure

-

Unlike land, a flat (the building structure) loses value over time.

-

After 20–30 years, old buildings may become less attractive or even need redevelopment.

2. Recurring Maintenance Costs

-

Apartments come with monthly maintenance charges (?1,000 to ?10,000+ depending on amenities).

-

Must be paid even if the flat is vacant or unsold.

3. No Land Ownership

-

With a flat, you don’t own the land—only the built-up area.

-

Land is what appreciates the most in real estate.

4. Limited Control Over Property

-

You can't make major changes, extensions, or customizations to the flat.

-

Must follow society or RWA (Resident Welfare Association) rules.

5. Builder/Construction Risk

-

Delays in handover or poor construction quality are common issues in under-construction projects.

-

Always verify RERA registration, approvals, and builder reputation.

6. Poor Resale Value for Older Flats

-

Older flats (15+ years) become harder to sell.

-

Buyers usually prefer new projects with modern amenities and design.

Summary: Pros vs. Cons Table

| Aspect | Pros | Cons |

|---|---|---|

| Rental Income | Regular monthly income | May face vacancies |

| Affordability | Lower entry cost than house | Still costlier than land in rural areas |

| Amenities | Security, clubhouse, lifts | Come with maintenance cost |

| Ownership | Easy to buy and sell | No land ownership |

| Appreciation | Good in cities | Limited in long term compared to land |

| Tax Benefits | Home loan deductions | NA |

| Resale | Easy in early years | Difficult after 15+ years |

Is Buying a Flat or Apartment a Good Investment?

Buying a flat or apartment is a good investment in the following cases:

-

You want monthly rental income

-

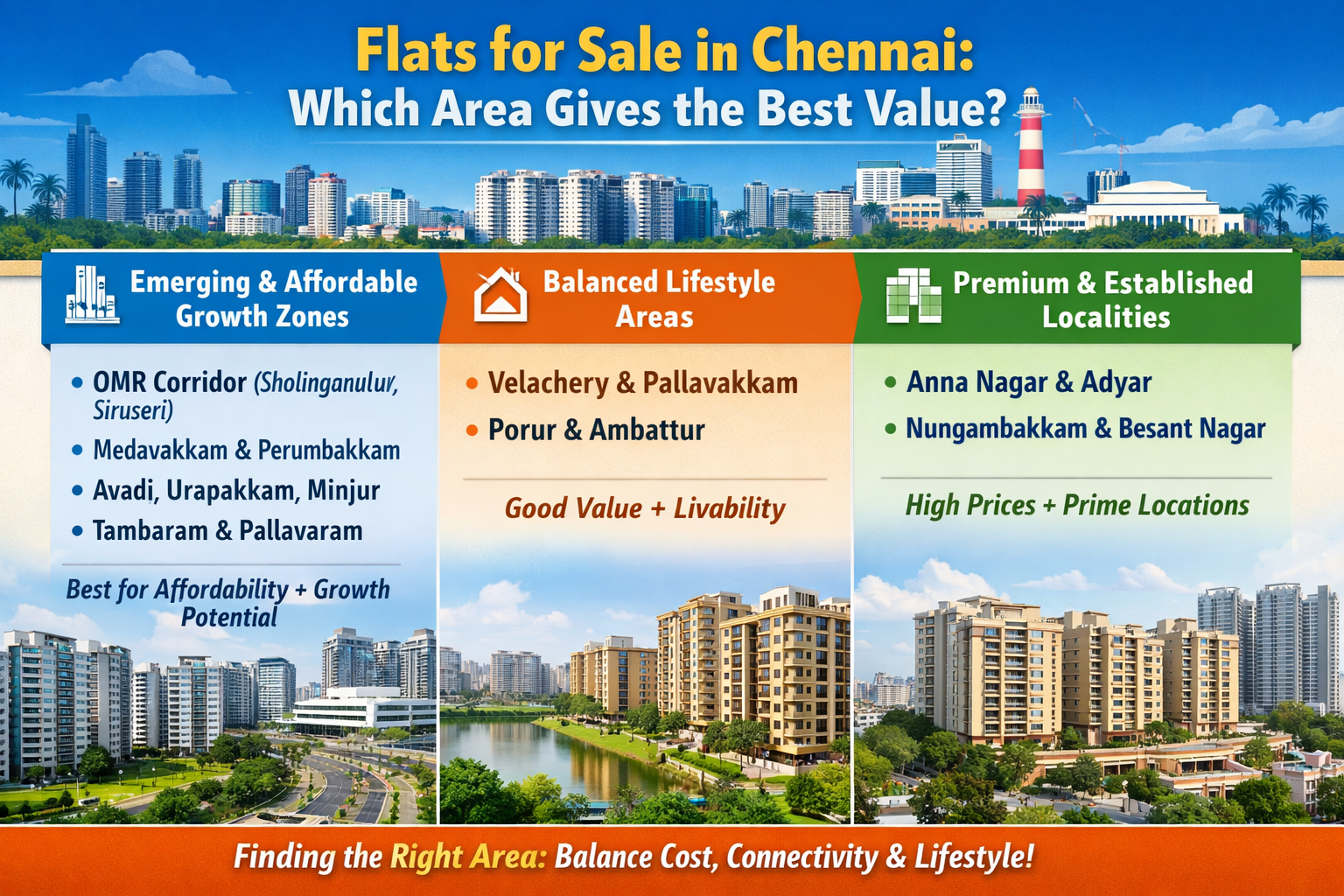

You're investing in a developing or metro city

-

You prefer a low-maintenance, secure environment

-

You're a first-time real estate investor

However, it may be less ideal if:

-

Your goal is long-term capital appreciation

-

You want full control or expansion options

-

You are comparing it to land investment, which may appreciate faster

Ideal Strategy:

-

Invest in a flat only in a high-demand, urban location

-

Choose ready-to-move properties or reputed builders

-

Look for rental potential over resale value

-

Avoid buying flats in underdeveloped areas or poorly maintained buildings

https://www.livehomes.in/blogs